Search Results

Inkle raises $1.5M to power tax & accounting for US cross-border companies

by: Startacus Admin ~ 6th February 2023

Global tax and accounting SaaS startup Inkle secures investment to support non-US based founders with US-registered businesses to meet their regulatory demands.

Almost half of the 20,000 US companies created on Stripe’s Atlas incorporation platform alone (of which almost 10,000 were formed in the year leading up to June 2021) were created by non-US-based founders. In helping th...

Read Post »

Read Post »

Outmin - SME accounting made quicker, cheaper, and simpler

by: Startacus Admin ~ 12th December 2022

Dublin-based fintech startup Outmin combines real experience and AI to support SMEs with all their bookkeeping, tax and accounting needs.

Managing accounts is no one’s idea of fun, but it is a vital part of any business. For SMEs, there is the option to spend a lot of money on outsourcing their accounting or hiring dedicated finance employees, or a lot of money and time on products and so...

Read Post »

Read Post »

Earnr - bookkeeping for the self-employed

by: Startacus Admin ~ 29th December 2021

Small business owner or creator and hate doing your tax returns? London-based fintech startup Earnr has created a platform that can help...

Tax returns. Anyone who doesn’t throw these at an accountant to do for them knows the stress of seeing the tax deadline approaching and knowing they’ve done a bad job of keeping their books up to date.

Despite it turning out to be simpler...

Read Post »

Read Post »

Dealing with Political Change in a Global Business

by: Startacus Admin ~ 11th September 2020If you're planning on expanding your business internationally, here are just a few of the key legal issues you should be considering

Expanding a business overseas can be an intelligent strategic move once a business has found success domestically and it is a great way to reach a new market and take the company to new heights. It can also be difficult as there are many aspects which must be consid...

Read Post »

Read Post »

Startup of the Week - PROfiltr

by: Startacus Admin ~ 22nd May 2019In need of an accountant? PROfiltr is a marketplace startup aimed at helping startups and SMEs alike...

Whether you’re an early stage startup or you’ve been in operation for quite a while, the fact remains that you will need an accountant. It’s a given. After all, from initial company formation to VAT returns, they provide a service that is essential.Choosing an accountant ...

Read Post »

Read Post »

Startup of the Week - TaxScouts

by: Startacus Admin ~ 24th April 2019Tax returns made easy thanks to TaxScouts, the FinTech startup which is shaking up how personal taxes are done in the UK....Ever had to complete a self-assessment tax return? If you have, chances are you’ve put the task off as long as you could and have ended up submitting it at the very last minute or, worse still submitted it late and been hit with fixed penalty as a result. It can be...

Read Post »

Read Post »

Making Tax Digital marks the end of paper reports

by: Startacus Admin ~ 10th April 2019The new Making Tax initiative waves goodbye to paper reports once and for all. As it started from the beginning of April 2019 here's a handy overview.

Just when we think we've found our stride amidst business meetings various, marketing efforts, managing your staff, and stressing over making ends meet - we get hit with another curveball. As if running your own startup wasn't difficult enough - we...

Read Post »

Read Post »

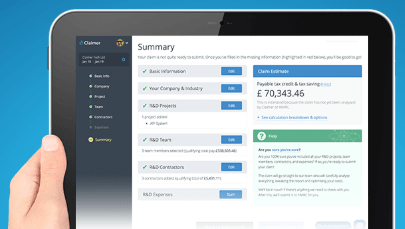

Claimer wants to be the app for R&D tax credits

by: Startacus Admin ~ 8th November 2018Currently in private beta, Claimer wants to be the app for R&D tax credits, helping businesses to easily get money back from their R&D spend and at a fraction of the current cost, with a flat 5% fee.

As a quick explainer, R&D Tax Credits is a UK Government tax initiative designed to help companies to invest in R&D. The UK Gov can obviously do better job at explaini...

Read Post »

Read Post »

Hammond: UK Might “Go it Alone” on Digital Services Tax

by: Startacus Admin ~ 12th October 2018A couple of weeks ago, UK Chancellor Philip Hammond chose his Conservative Party Conference speech to suggest that he wouldn’t wait for an international consensus on digital services taxation. Bradley Post, Managing Director of RIFT Tax Refunds, shared all on what this might mean...

It was a surprising statement for many, but the dust it’s kicking up has been all-too predict...

Read Post »

Read Post »

Tips for Making a Successful R&D Tax Credits Claim

by: Startacus Admin ~ 24th April 2018Many innovative startups and SMEs are under the impression that claiming for research and development tax credits are too difficult or costly to be worth the rewards. In fact, the average R&D tax claim for London SMEs for example is £81,000, so it’s always worth finding out if you can claim.

EmpowerRD, backed by Forward Partners, has been disrupting the R&D tax credit space si...

Read Post »

Read Post »

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.