Five Practical Business Tips Every Startup Should Know

by Startacus Admin

4. Compliance with the Law

Many start ups are not aware of what they must do to be compliant with the law, for example:

- Sole traders and partnerships must notify HMRC when they start trading. If they don't, there are penalties. You can notify them via the HMRC

web site.

web site. - You must keep proper accounting records. That means sufficient to provide the relevant details of all transactions. So, for example, HMRC might ask for a breakdown of all your cost of materials, select one and ask to see the invoice. If you can't produce it, they will disallow that cost and assume you have others that you can't justify. Apart from having your costs disallowed and your tax increased, there are penalties for failure to keep proper accounting records.

- If you are employing staff, you will need to register a payroll scheme with HMRC and account to HMRC for tax and National Insurance contributions on their salaries.

- If your sales go over the VAT registration threshold, currently £81k pa, you need to register for VAT.

Now there is no way most people would know about these things. And there are other things most people would not know about, such as what you need to do in order to be able to claim motor expenses against tax and how you can claim extra VAT back when you start a business. So keep your accountant informed about what you are doing - preferably before you do it, because sometimes, if you miss an opportunity, you can't go back and fix it.

5. Use of Home as Office

If there is any part of your home that you use exclusively for work at any time, you can set a portion of the costs of running your home against your taxable business profits, so that makes your taxable profits (not your real profits) lower, and you pay less tax. If you want to know how to do this, there are instructions on the HMRC web site. Just Google "HMRC use of home". Remember, it decreases your taxable profits, not your real profits.

Who is Tom? Tom Trainer BSc FCA, is a Chartered Accountant and owner of CharteredAccountantOnline.com

Linked IN: https://www.linkedin.com/in/tomtrainer

Facebook: https://www.facebook.com/CharteredAccountantOnline

Twitter: https://twitter.com/CAOaccounting

Goole+: https://plus.google.com/u/0/+TomTrainerCAO

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

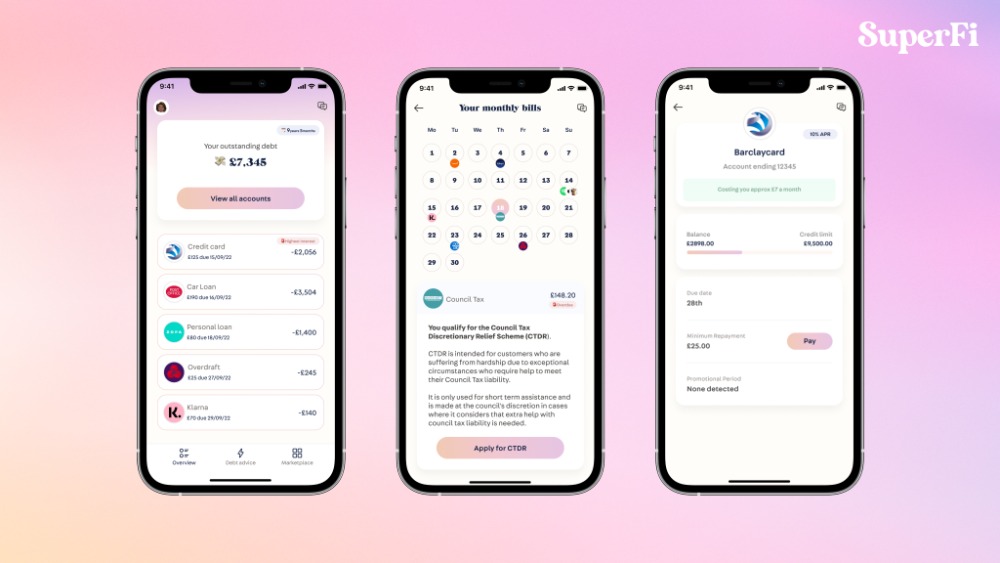

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

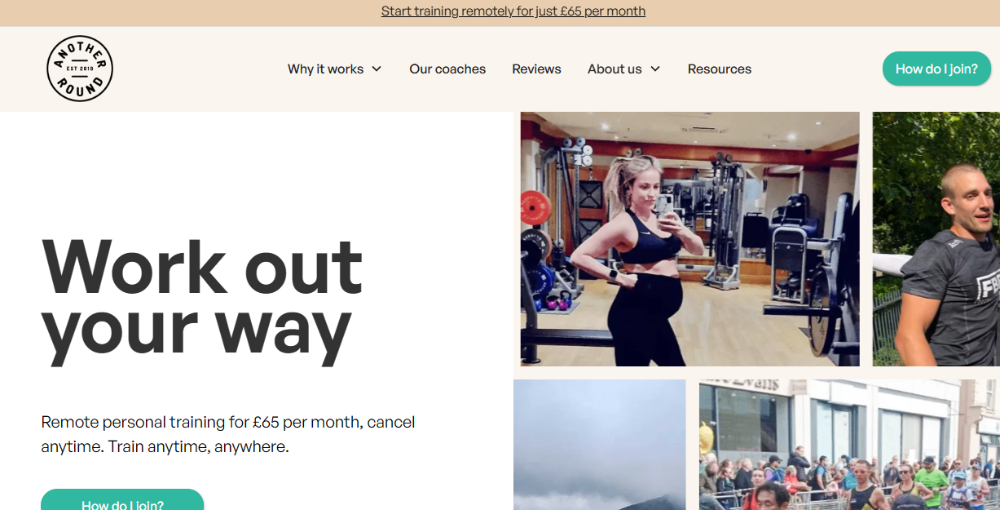

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

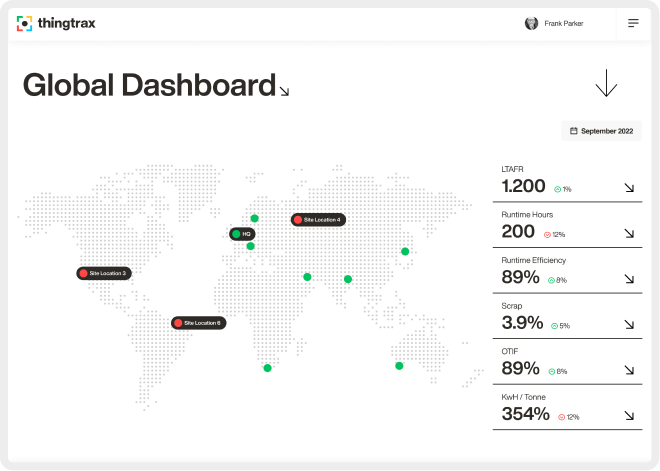

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 10th August 2014

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)