Starting a Charity - Some Key Information

by Startacus Admin

You may wish to become a charitable company if;

-

You intend to grow into a fairly large organisation

-

You have (or will have) employees

-

You plan to enter into commercial contracts such as the provision of services

3) Trusts - These are quite different from the other types of charities because they are concerned (mostly) with the distribution of money (in the form of grants) from a central fund and, on the whole, do not undertake the wide range of activities that you would expect of a typical charity. As was the case with unincorporated associations, trusts do not enjoy the advantages of having legal status. This would be an appropriate category if your charity will make grants to individuals and organisations, be run by a small group of people who will administer the funding and not be employing any staff.

4) Charitable incorporated organisations - This final category of charity is something of an amalgamation of  the first two and came into being in 2012. They receive the benefits which come from being classified as a company without actually having to register with Companies House. Charitable incorporated organisations can enter into contracts and its trustees will normally have limited or no liability for any debts which the charity amasses.

the first two and came into being in 2012. They receive the benefits which come from being classified as a company without actually having to register with Companies House. Charitable incorporated organisations can enter into contracts and its trustees will normally have limited or no liability for any debts which the charity amasses.

It can be quite tricky to work out which of these categories you will fall into, so be sure to pay a visit to the Charities Commission Website where you will find lots more information.

Do you need to register your charity?

Depending on a number of factors you may or may not have to register your charity with the Charities Commission. Generally you must register if your income is at least £5000 per annum however this does not mean that if your charity is earning less than this, it cannot benefit from the financial and legal benefits. You should apply to HMRC to ensure that you are receiving the tax breaks and gift aid that you are entitled to.

In some other cases, charities do not need to register with the commission because they are already being regulated by an independent body - such charities can include universities, national museums and galleries and some school governing bodies.

Other organisations are prevented from registering with the Charity Commission until their annual income reaches the point of £100,000 per annum because they are supervised by, or accountable to, another body or authority. These organisations are known as ‘exempt charities’ and can include churches and chapels of some Christian denominations, charitable funds of the armed forces and scout and guide groups.

Setting up a charity can be a really fulfilling and worthwhile undertaking so please don't let yourself be put off by all of the red tape - the chances are that most of the information here won't apply to you, but it’s always best to check with the Charity Commission's website just to be sure.

Join Startacus - the Self Start Society!

If you like what you see here on Startacus, why not become a member of our growing community? It's free! And you'll get all this - exclusive access to our Business Toolkit, discounts and offers galore for your business via our member only business deals, the chance to network and connect with loads of fellow self-starters, and maybe even become our celebrated 'Self-Starter of the Week' and tell the world your startup tale! Join right here for free

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

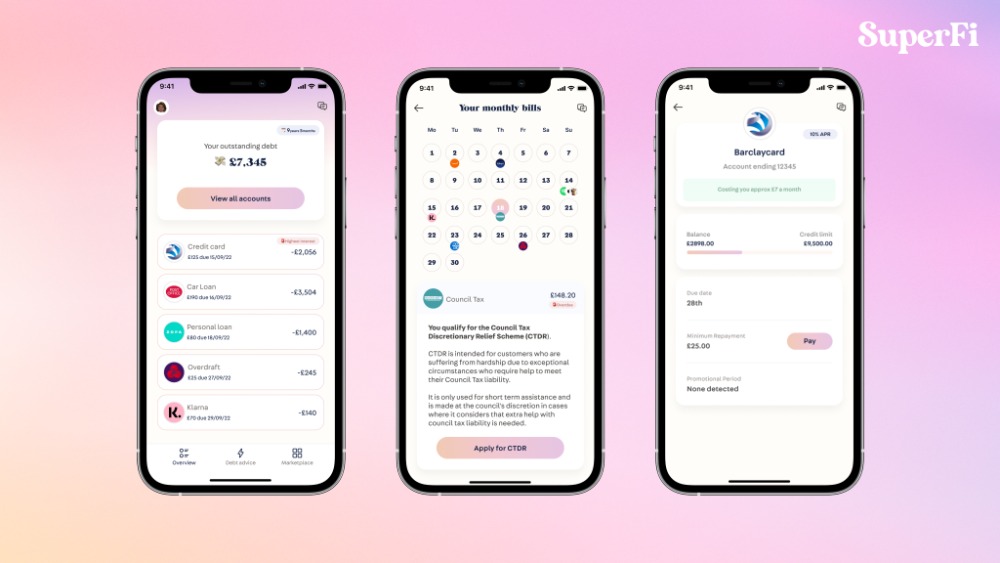

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

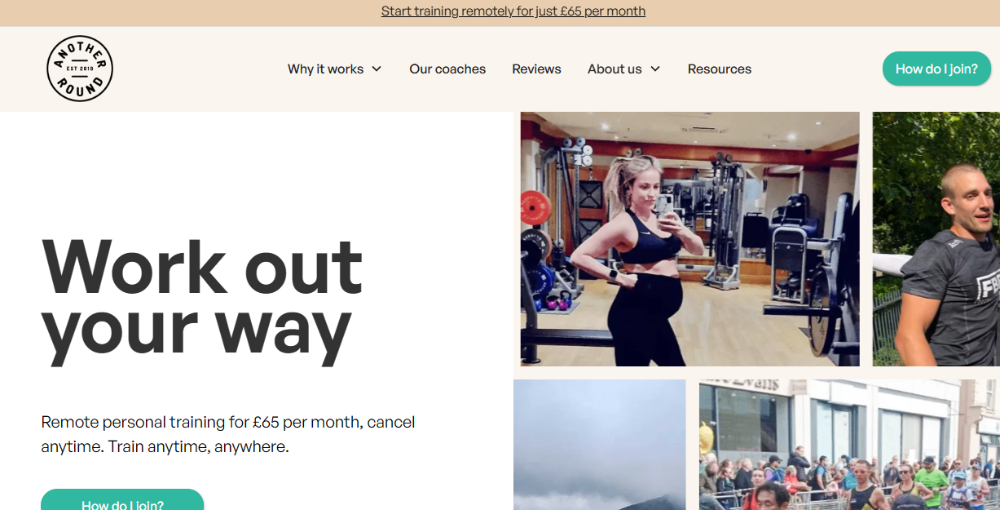

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

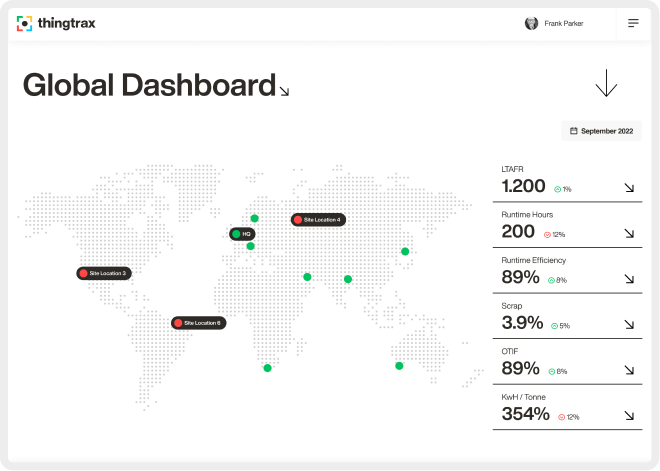

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 24th February 2014

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)