Starting a Charity - Some Key Information

by Startacus Admin

Why become a charity

With such strict legislation and regulation it’s hardly surprising that becoming a charity brings with it a number of benefits and exemptions that aren’t open to traditional business, here are some of the key points you may be interested to hear.

benefits and exemptions that aren’t open to traditional business, here are some of the key points you may be interested to hear.

-

Exemptions from income or corporation tax on some types of income

-

Total exemption from capital gains tax

-

Total exemption from stamp duty

-

Exemptions on Inheritance tax (allowing people to make them a tax free gift in their will)

-

Charities pay no more than 20% of normal business rates on occupied buildings

-

Special VAT regulations can be applied in some circumstances

Different Types of Charity

Charities are regulated by the Charity Commission and must register with it once their income exceeds £5000 p.a. Within the UK they are classified neatly into 4 categories, depending upon what you would like your charity to do.

1) Unincorporated associations - This is normally the simplest way in which to set up a charity and is most appropriate for small organisations or groups of people who wish to work together for one, or a number of charitable purposes but are planning to remain small. The downside of choosing this structure is that you will not have legal status, meaning that the activities of the charity may be restricted. Typically as an unincorporated association your charity will not be able to employ staff, own land or hold investments in its own name.

2) Charitable Companies - The word ‘company’ is of great significance within this particular structure because in the eyes of the law a company can hold a similar legal status to a person. This means that a charitable company has the ability to own land/property and enter into contracts in its own name rather than through that of its trustees. This, not only allows the charity to grow to a more considerable size than an unincorporated association but also helps to remove liability for the charity’s activities from the trustees. These charities therefore have what is known as ‘limited liability’ meaning that trustees and members will be responsible for a very small amount of any financial liability that charity incurs (normally a figure around £5). Got a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read... Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs. Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives. Roger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students. SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis. 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms. Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community. Thingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future A measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated Bedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

You may wish to become a charitable company if...continued on page 3

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here.

How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy Costs SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance Gap How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives  How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AI SuperFi raises $1M pre-seed funding round

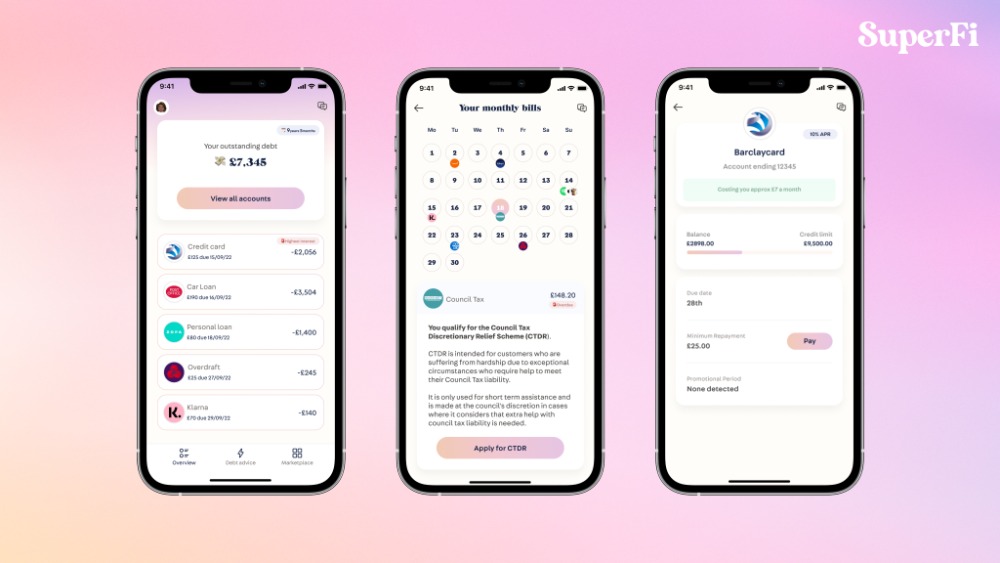

SuperFi raises $1M pre-seed funding round Startups rely on AI & sustainability for new partnerships

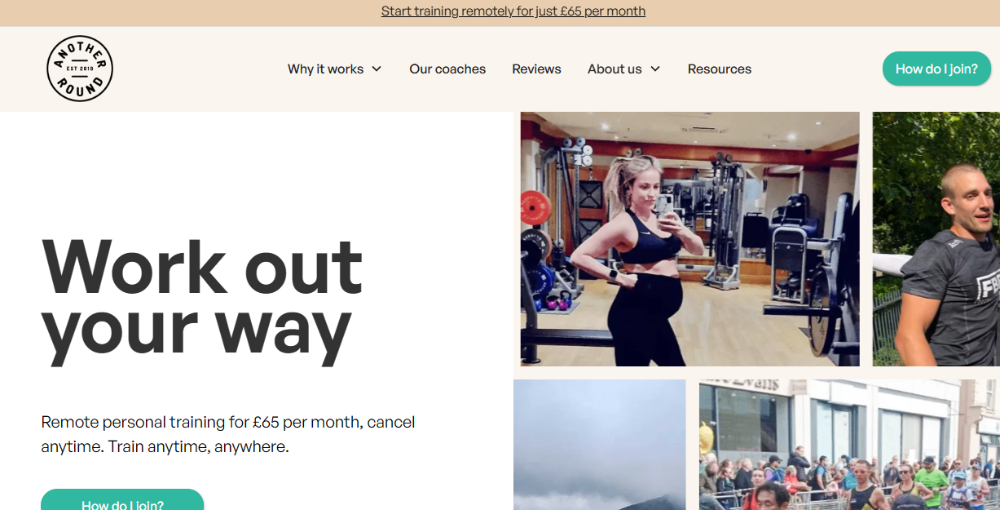

Startups rely on AI & sustainability for new partnerships Another Round closes £300k Seed round to revolutionise personal training

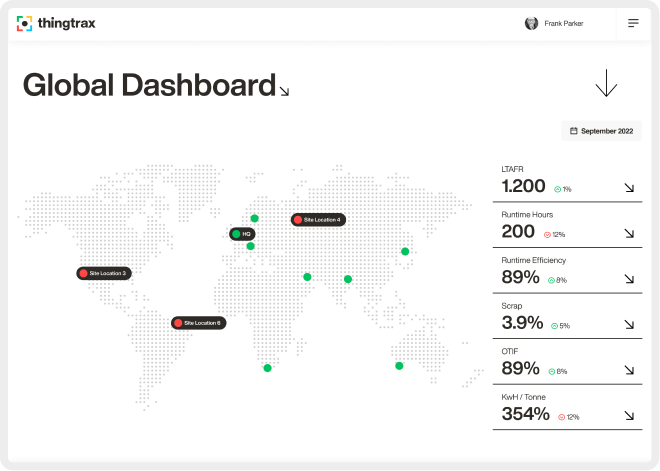

Another Round closes £300k Seed round to revolutionise personal training Thingtrax Secures £4.3M

Thingtrax Secures £4.3M A measure of inflation relief for small firms

A measure of inflation relief for small firms A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHub

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)