B2B insurtech BondAval secures major funding

by Startacus Admin

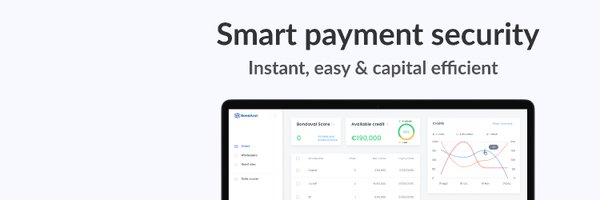

BondAval secures $1.64 Million Pre-Seed funding to help accelerate its product roll-out, further develop its machine-learning technology and expand its team

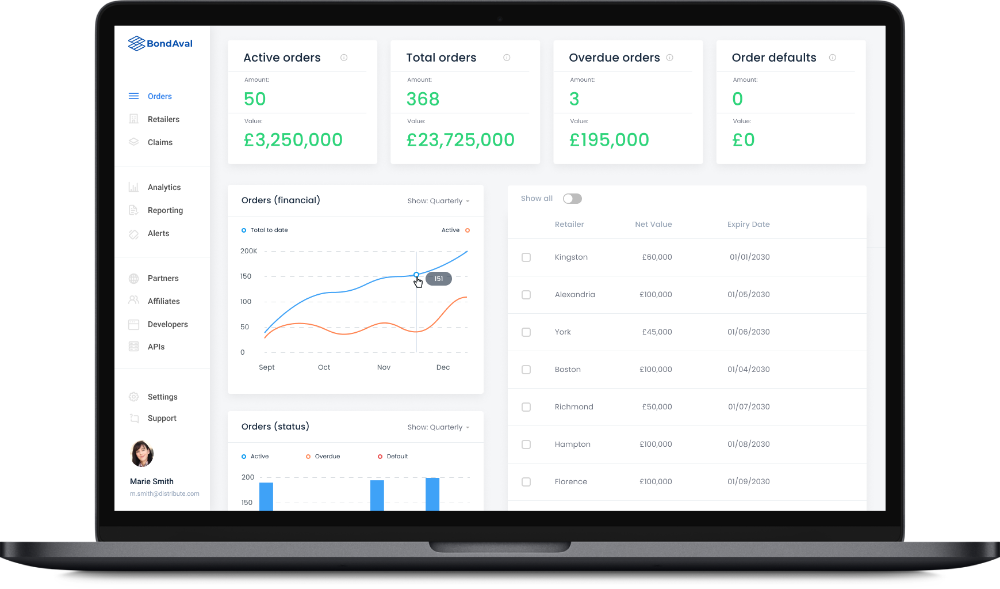

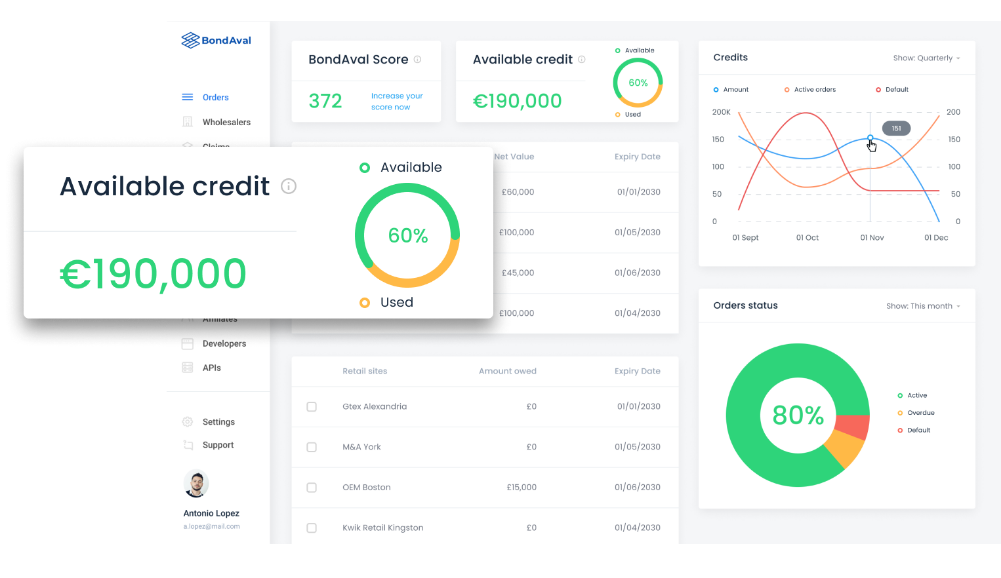

BondAval democratises access to the best credit terms via its unique credit risk engine, which enables the instantaneous issuance of its innovative new product – MicroBonds. MicroBonds provide investment-grade certainty to wholesalers when securing their stock and inventory.

Founded early last year by Tom Powell and Sam Damoussi, the development of this novel insurance product is enabled by the use of data and technology. MicroBonds offer a new financial instrument to level the playing field for independent retailers. The co-founders have a shared ambition of bringing customer-centric and digital-first principles to a traditionally slow-moving and opaque sector and believe they are well positioned to provide an innovative new product offering to the €2.5tn+ of global exposure secured by trade credit insurance globally.

Founded early last year by Tom Powell and Sam Damoussi, the development of this novel insurance product is enabled by the use of data and technology. MicroBonds offer a new financial instrument to level the playing field for independent retailers. The co-founders have a shared ambition of bringing customer-centric and digital-first principles to a traditionally slow-moving and opaque sector and believe they are well positioned to provide an innovative new product offering to the €2.5tn+ of global exposure secured by trade credit insurance globally.

BondAval Co-founder and CEO Tom Powell said, “The gulf between corporates and independent retailers trying to secure credit terms is vast and, in our opinion, unfair. Our vision at BondAval is to redress this balance, allowing independent retailers to leverage investment grade security. Their word – our bond. To achieve this vision, we are excited to partner with our new investor shareholders, led by Insurtech Gateway. They understand the value we can bring by applying digital first propositions to the world of B2B insurance. “

Sam Damoussi Co-founder and COO continued “Independent retailers are competing on an uneven playing field when it comes to credit terms. We also see a huge delta in the user experience between the B2B and B2C insurance sectors. By leveraging technology and the founding principles of insurance we can level that playing field and vastly improve the user experience. We look forward to growing our team and raising the bar across the industry in order to deliver on our plans for the next year.”

Sam Damoussi Co-founder and COO continued “Independent retailers are competing on an uneven playing field when it comes to credit terms. We also see a huge delta in the user experience between the B2B and B2C insurance sectors. By leveraging technology and the founding principles of insurance we can level that playing field and vastly improve the user experience. We look forward to growing our team and raising the bar across the industry in order to deliver on our plans for the next year.”

The company will be using the capital raised in order to accelerate its product roll-out, invest in recruitment, and further the development of its machine-learning technology. Regulatory and administrative approvals are underway, with commercial sales expected to start this year.

Robert Lumley, co-founder Insurtech Gateway commented, “BondAval's digitised product will make life so much easier and more efficient for retailers to secure credit from their wholesalers and suppliers. We look forward to working with Tom, Sam and the BondAval team to launch their proposition in Europe and the US."

BondAval is a startup that is most definitely worth watching!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

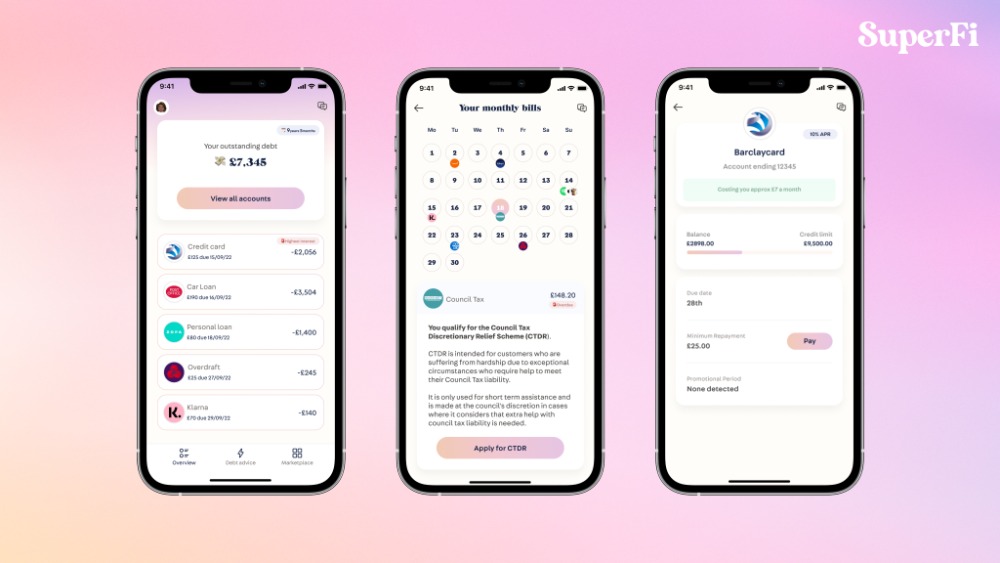

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

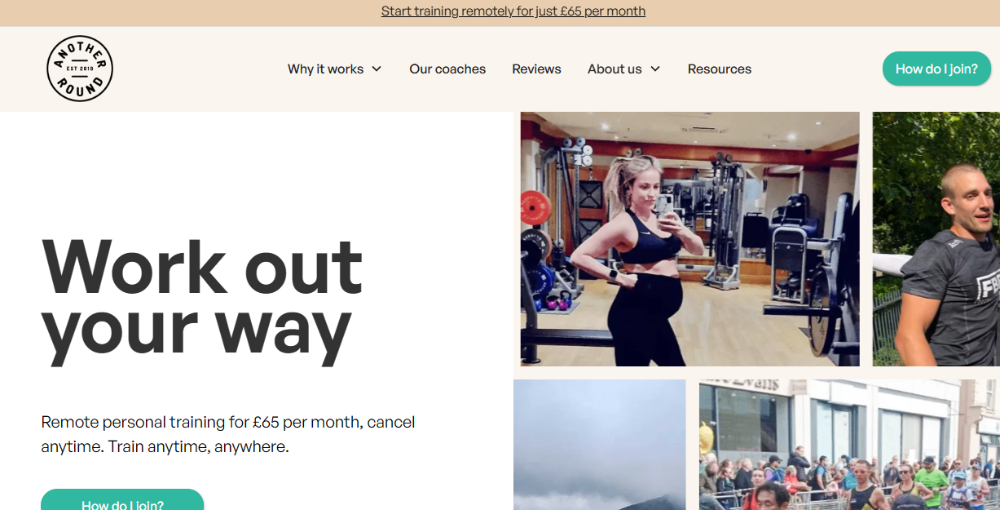

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

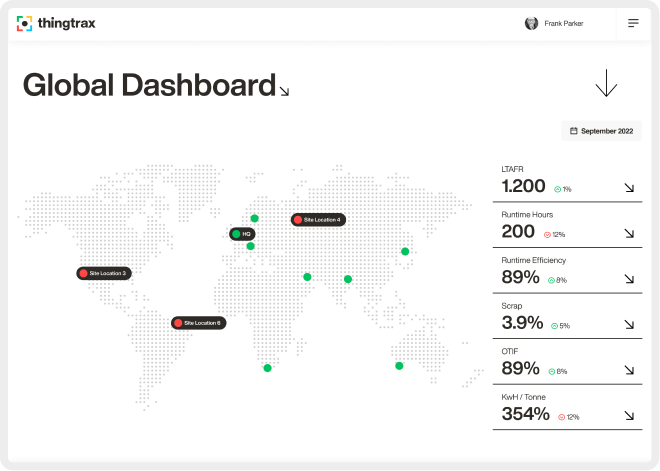

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 26th January 2021

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)