EIS is more for investors than startups

by Startacus Admin

Martin Neill is the Founder & CEO at AirPOS, a Belfast based cloud-based ePOS software platform which offers point-of-sale and e- commerce software to helps small retailers manage their sales and inventory, both in their shops and online. Here, Martin shares some invaluable thoughts and knowledge on raising investment as a startup and why EIS is perhaps more for investors than startups.

commerce software to helps small retailers manage their sales and inventory, both in their shops and online. Here, Martin shares some invaluable thoughts and knowledge on raising investment as a startup and why EIS is perhaps more for investors than startups.

Over to Martin to explain all...

Entrepreneurs! Never underestimate the importance of your first round of funding! Hey you! Yeah you! Stop moving at 200mph and consider a little bit the road ahead! Oy! OY! Ah whatever.

Seven years beyond AirPOS first round of funding and seeking our fifth, it’s easy to be critical of first-time entrepreneurs who are solidly in the flush and frenzy of the first dance. I meet a lot of them, sent my way mostly by the explosion of tech incubators in Belfast but also referred by investors and people around the startup scene. Some have great ideas, some have great notions of great ideas and others have small businesses dressed in a startup coat. For all their diversity and wildly differing future prospects they all have two things in common; they need to raise funds to build their business and they need to know how a term sheet works. Term sheets are devilish things, often stuffed full of obscure clauses and notions almost all of which are designed to protect the funder from the potential lack of capability or general possible stupidity of the entrepreneur. This is understandable. Fund managers who invest money unwisely are highly unlikely to get the opportunity to do so again and therefore downside, upside, leftside, rightside and underneath protection serves somewhat to derisk what are the most risky of business transactions. And there is no more risky a transaction than the first round of funding.

What’s on paper is not likely at all to be the reality of what occurs and the investor has to read between the lines to try to weigh up the possibility of making a return. This is why exited entrepreneurs make excellent VCs and accountants, who you usually find heading up institutional funds and government backed capital, don’t. There is no spreadsheet for hope, no metric for luck (or lack of) and no advance indicator of serendipity. There is only the problem and the businesses likelihood of solving this problem, which is always highly unlikely.

What’s on paper is not likely at all to be the reality of what occurs and the investor has to read between the lines to try to weigh up the possibility of making a return. This is why exited entrepreneurs make excellent VCs and accountants, who you usually find heading up institutional funds and government backed capital, don’t. There is no spreadsheet for hope, no metric for luck (or lack of) and no advance indicator of serendipity. There is only the problem and the businesses likelihood of solving this problem, which is always highly unlikely. And you can bet your bottom dollar (and you might have to if you’re not careful) that the business will require multiple rounds of funding. That is the same in the US, the UK, the Outer Hebrides and the Arctic Circle. That is one thing you can be sure of.

This surety means that the first round of funds is perhaps the most crucial a startup will ever raise. It sets the terms of engagement for the business and its investors but it also sets the tone of that relationship, and therefore has a heavy effect on the culture of the company that grows from this initial catalytic event. One experienced investor in our first round kept repeating the warning “if this is what it’s like when we’re engaged, what will it be like when we’re married?” Sage advice, and advice that guided our actions.

So you’ve got an idea or a prototype that there’s clearly a market for, you’re on the road to solving a problem that has some value and you have a set of terms from investors. All good so far, the blood, sweat, tears and fear are starting to pay off perhaps?

Enter three letters that will appear at this point in every UK fundraising scenario; namely EIS. EIS is the Enterprise Investment Scheme, a UK government initiative that was introduced in 1994 to encourage equity investment into higher risk small companies by offering both income tax and capital gains reliefs to investors.

From the investor's perspective EIS is great news and serves as a great de-risker against investments for both high net worth individuals and also those in the higher earning bracket as there is no minimum investment amount (there used to be, not anymore). In fact without EIS it’s highly unlikely that crowdfunding sites such as Crowdcube and Syndicate Room would have had the success they’ve had to date. As a means of moving money it’s estimated that EIS has encouraged £10 billion in investment over the 23 years it has been in operation.

From the entrepreneur's perspective any money moved towards high risk investments is great news also, especially in the UK where the funding networks are not nearly as

developed as those in the US and there aren’t nearly as many exited founders seeking to reinvest into further successes. There is however a little discussed and potentially huge downside to EIS, especially in initial funding rounds.

developed as those in the US and there aren’t nearly as many exited founders seeking to reinvest into further successes. There is however a little discussed and potentially huge downside to EIS, especially in initial funding rounds. In order investors money to qualify for EIS relief they must invest into common (sometimes called ordinary) shares. Common shares are essentially shares that are purchased at the stated price, with no discounts, uplifts or other such terms allowed. To explain normally there are two mechanisms for funding startup companies; equity investment or another instrument known as a convertible loan.

There are a number similarities between these instruments but there is one very crucial and important difference. In an equity investment scenario there must be a valuation of the company in order for there to be a share price. With convertible loans this is not normally the case, a valuation is either set at the next equity round or worked out at the point which investors decide to convert their loan to equity. For their risk loan holders usually get around a 20% discount on any share price set later.

Where EIS can be dangerous is that investors who insist on EIS relief (a lot of investors in the UK won’t invest without this) are essentially forcing a company to set a valuation on their shares. At the early stages, this is a very difficult if not impossible thing to do. A pre-revenue company with an early stage tech is about as vaporous an entity as you can get. Include a perhaps inexperienced team (or two individuals in many cases) and you have something of highly debatable value.

Given that most startups who are serious about growth will need investment in order to make real progress, you have a scenario that is heavily rigged towards the investors. The entrepreneur (s) will typically be running out of runway and needing to raise funds, limiting their ability to argue an acceptable valuation that they feel they can spend the next 10 years of their life slogging their guts out under. Advantage investors.

Any venture capital funds involved will likely need to accommodate an EIS friendly approach into their thinking if they wish to attract co-investors, making for either supremely complicated mixed loan and equity term sheets and financial instruments or again forcing equity purchase in order to let the EIS guys have their reliefs. Making setting a valuation the shortest route. Again advantage investors.

Any venture capital funds involved will likely need to accommodate an EIS friendly approach into their thinking if they wish to attract co-investors, making for either supremely complicated mixed loan and equity term sheets and financial instruments or again forcing equity purchase in order to let the EIS guys have their reliefs. Making setting a valuation the shortest route. Again advantage investors. The outcome of this I’ve seen most often is entrepreneurs who have taken a bloody nose on valuation in their first round as that’s a better outcome than not raising the funds. The 30% or so of the shares in the business that they have sold in the first round by setting a lower end valuation is acceptable given the risk that the investors have taken. Within a year they will likely be back around the table talking about round number two. And there will be EIS investors in this round also most likely, as most will know that in order to have a realistic chance of a return down the line it’s a good idea to follow their money again forcing a valuation.

All of this amounts to a bizarre situation in that the rules of a government scheme are having a wide-reaching influence on venture capital raises across the UK. A compromise would be that EIS had as agreed valuation mechanism i.e a methodology that EIS investors must follow in order to get their reliefs or that EIS reliefs are available on convertible loans but only upon conversion to equity which would be in line with what’s happening today. Either way there needs to be a levelling of the playing field, or we reap the consequences of low ball valuations and mis valuations on companies that could have been worth so much more.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

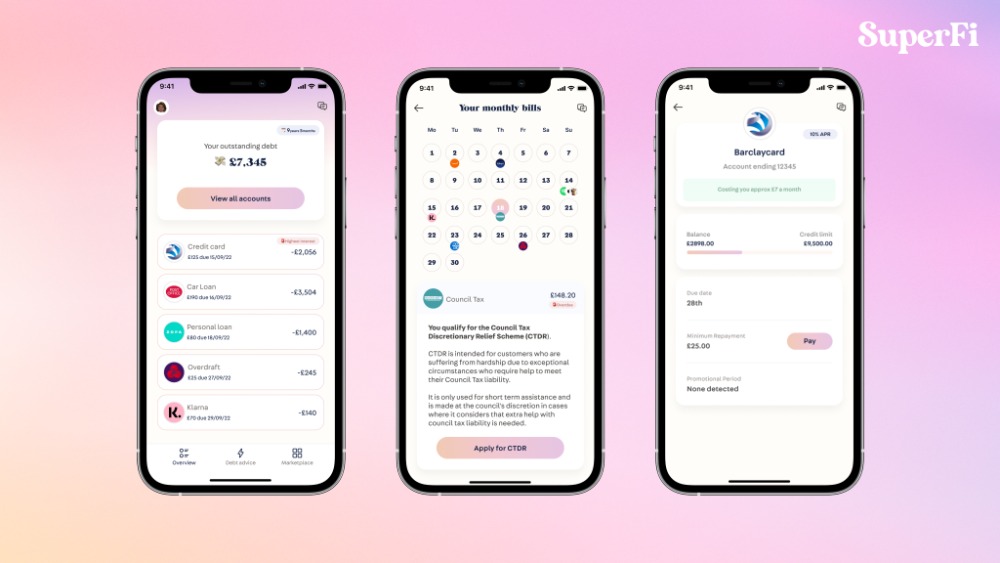

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

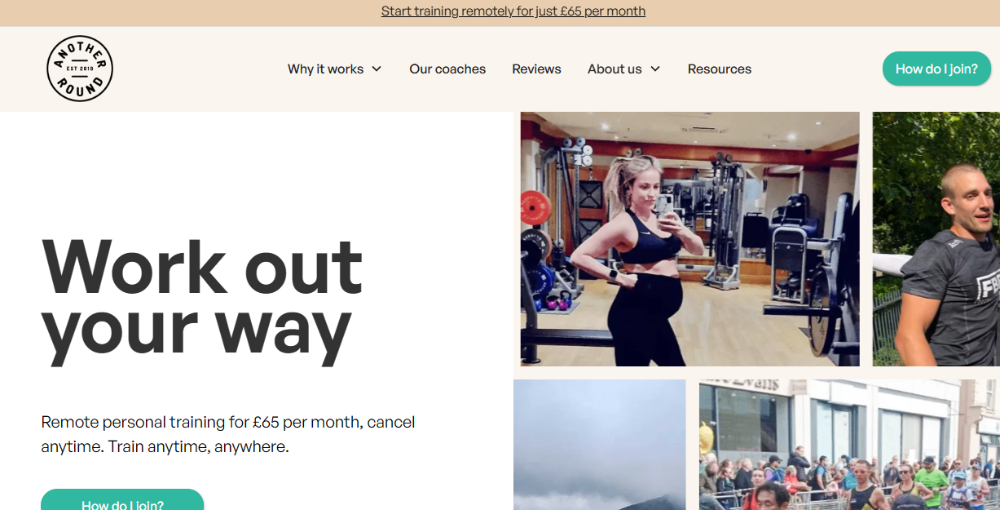

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

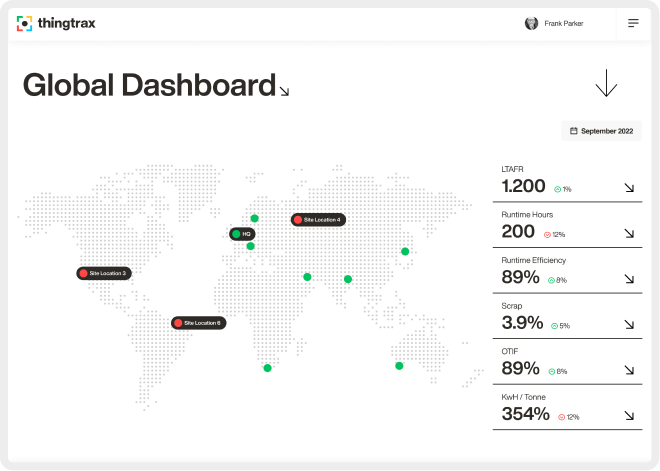

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 25th August 2017

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)