When is the right time to set up a formal finance function in your burgeoning startup?

by Startacus Admin

.jpeg)

Establishing a formal finance function for your startup? Carlo Gualandri, Founder and CEO, Soldo outlines when and where to start...

Most startup business owners set out with either themselves or a trusted employee in charge of finances, often as a way to keep complete control. But as the business starts growing, taking on more clients and personnel, it soon becomes impractical, prompting them to consider establishing a formal finance function. Successful entrepreneurs know that SMEs with well-developed financial capabilities are much more likely than others to be growing rapidly and sustainably. Developing a formal finance function is therefore critical for planning, especially for predicting cash flow – the lifeblood of any business. The impetus for such a function often comes from investors or supply chain partners, but when is the right time to heed the call and where do you start?

Make sure the basics are in place

.jpeg) An emerging finance function consists of three essential building blocks – a bank account, payroll, and accounting software. These will be the foundation on which your finance department will build all subsequent work, so should not only cater to your business’s current needs but also anticipate future needs.

An emerging finance function consists of three essential building blocks – a bank account, payroll, and accounting software. These will be the foundation on which your finance department will build all subsequent work, so should not only cater to your business’s current needs but also anticipate future needs.

A dedicated business bank is not only a legal requirement, but it facilitates supplier payments, cash flow management, tax dealings, and profit calculation. It is useful to do a proper assessment of your current business account before setting up your finance function. Look at aspects such as compatibility with the technology you want to utilise, whether the banking fees are competitive and whether it caters for all the services and integrations you need.

Sourcing the right business bank is similar to the process you would follow for any other business supplier. Shop around for the best price, service, and benefits for your business with thorough research.

Also, consider additional tools such as software for payroll and accounting to supplement your business cash account. There are plenty of software offerings out there, so take your time to source a solution that best aligns with your needs. Cloud services, for instance, can be accessed anywhere and on any device – smartphones, desktops, laptops and other mobile devices. This makes it easy to stay in touch with your team while simultaneously having real-time control of your business’s cash flow.

Manage expenditure

Startups often overlook spend management early on by tracking expenses through employees only. Such an approach could quickly spiral out of control as costs rise and the employee numbers increase. For that reason, an efficient spend management solution is the next item the new finance department would need.

Research by Soldo found that almost a third (29%) of emergent businesses in the UK and Ireland struggle when choosing what business priorities to spend on. Nearly a fifth (18%) acknowledged that they didn’t have adequate financial insight to make good spending decisions. A way to track and regulate expenditure is, therefore, imperative to support sound decision-making.

The ideal opportunity to address spend management and get complete financial visibility is when you set up the finance department. Progressive companies should also consider spend automation, since automating recurring tasks will enable the finance department to spend more time on complex, analytical tasks.

Put data to work

.jpeg) Extracting the multitude of financial data your firm generates daily can yield useful information for managing your business more effectively. With accurate and even real-time data at their disposal, your finance team will be able to identify opportunities or inaccuracies quickly.

Extracting the multitude of financial data your firm generates daily can yield useful information for managing your business more effectively. With accurate and even real-time data at their disposal, your finance team will be able to identify opportunities or inaccuracies quickly.

Reliable data is also a prerequisite to attract investors and finance providers. Being able to present an accurate picture of the money entering and leaving the business signifies financial health and organisation, which makes it much easier to convince investors of your business’s viability. They will be more at ease to hand over ready money if your business has a slick and well-functioning finance department.

Set yourself up for scalable growth

While it is indeed difficult to envisage what the future holds in the current climate, businesses can still put plans in place to ensure the new finance department can scale alongside a growing business. The first step is to select sustainable software.

Cloud-based platforms have the most significant advantage since they are more likely to be supported for the foreseeable future and even receive regular updates. Automation is another requirement for scalability as it deals with many of the tasks that scale linearly with a budding business, such as receipt tracking and data input.

Operating without an effective finance function is most likely set up for failure. Conversely, a well-developed finance team transforms small businesses and helps them release their potential by increasing their profitability, streamline processes, and achieving faster, sustainable growth for longer.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

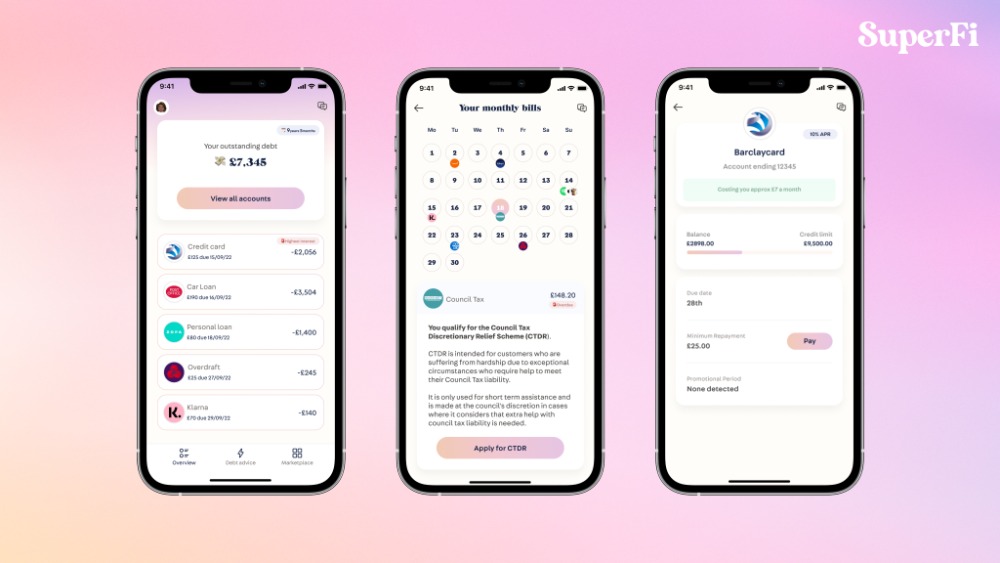

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

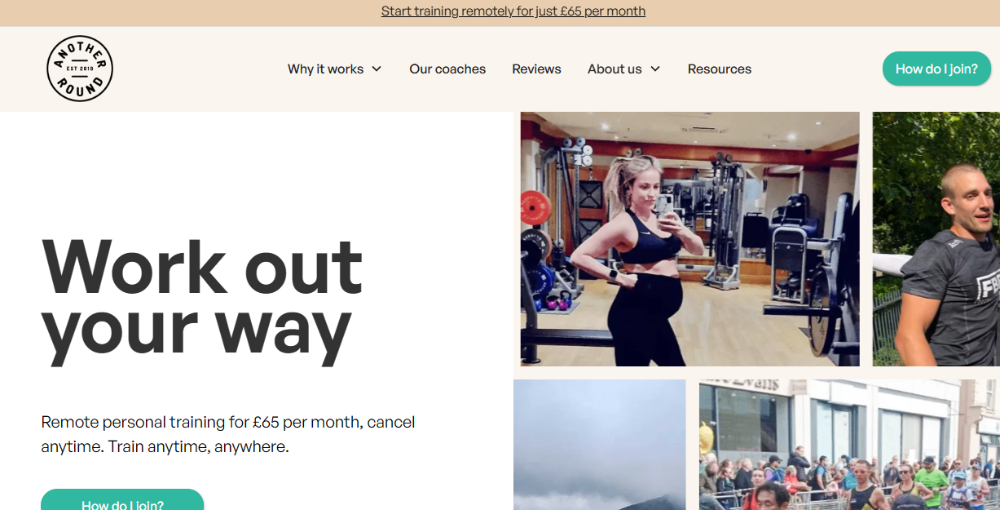

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

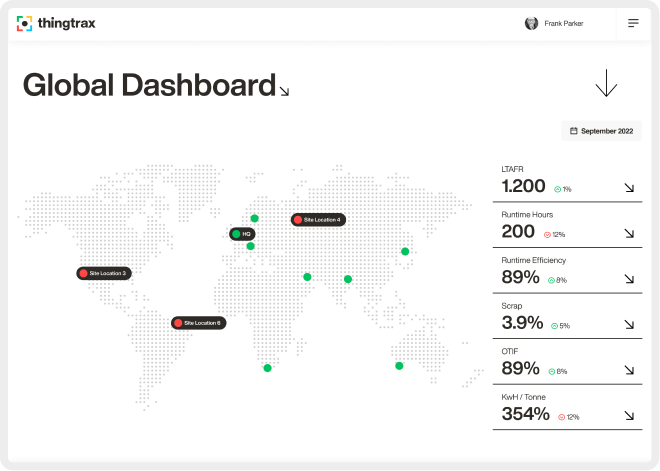

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 6th September 2020

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)