What you need to know about VAT

by Startacus Admin

VAT can be very frightening for anyone who runs their own small business, especially if you’re already  VATstruggling with paperwork and wondering what you should be telling the taxman.

VATstruggling with paperwork and wondering what you should be telling the taxman.

So what is VAT, does it affect you, and - if so - how do you register for it? Emily Coltman FCA, Chief Accountant to FreeAgent - which provides an award-winning online accounting system for small businesses and freelancers – explains more.

A quick introduction

VAT is short for Value Added Tax - or as I like to call it, Very Awkward Tax - and it’s a tax that’s charged on most sales of goods and services in the UK.

When your business makes sales, you don’t charge VAT to your customers unless you’re registered with HMRC to do so. Sales on which VAT would normally be charged are called “taxable sales”. Sales that are exempt from VAT, or outside the scope of UK VAT, are not taxable sales.At present you only have to register your business if its annual taxable sales are over the limit set by HMRC which, as of April 1st 2014, is £81,000.

When your business makes sales, you don’t charge VAT to your customers unless you’re registered with HMRC to do so. Sales on which VAT would normally be charged are called “taxable sales”. Sales that are exempt from VAT, or outside the scope of UK VAT, are not taxable sales.

At present you only have to register your business if its annual taxable sales are over the limit set by HMRC which, as of April 1st 2014, is £81,000.

Do I need to register for VAT?Do I need to register for VAT?

If your annual taxable sales are above £81,000 per year, or they will pass that limit in the next 30 days, then you must register for VAT (this is called compulsory registration).

In some cases you may also wish to register earlier - which is called voluntary registration. Registering before you have to do so can help your cashflow, because being registered for VAT allows your business to claim back input VAT on its costs (we’ll explain more about this later).

However if your customers are members of the general public or small businesses who aren’t registered for VAT themselves, it may not a good idea to register voluntarily, as you would have to charge them VAT which they wouldn't be able to claim back. This could mean that your customers might feel your prices are higher.

You can register for VAT either by filling in a paper form or registering online. If HMRC accept your application for registration, they will send you a certificate confirming this, which will also show your business’s unique VAT reference number.

OK, I’m registered - what next?

Once your business is registered for VAT, then it has to charge VAT on all the taxable sales it makes to its customers. The VAT you charge to your customers is called “output VAT”.

Your business will also be able to reclaim some of the VAT that its suppliers charge. (I say “some” advisedly, because there are some supplies on which VAT can’t be reclaimed, such as entertaining anyone other than staff). VAT that can be reclaimed is called “input VAT”.

VAT-registered businesses must file a regular report called a VAT return to HMRC. Your VAT return shows your business’s output VAT, less its input VAT - and the difference is what you must pay to HMRC.

If your input VAT is greater than your output VAT, lucky you – you’ll get a refund from HMRC!

Managing the transition period

You apply to be registered for VAT as from a certain date. There will usually be an interim period between that date and the arrival of your certificate and VAT registration number.

You’ll have to charge output VAT on any sales after your registration date – but until your VAT registration number arrives, you can’t issue official VAT invoices.

Reached an impasse? What you’ll need to do is add the relevant rate of VAT - usually 20% - to the total value of all your invoices as from the date you’ve applied to be registered from, so that you don’t have to go back and ask your customers for more money.

Once your VAT registration number comes through, you’ll then need to re-issue any invoices you’ve issued in the interim period to your customers. This is so that your customers have official VAT invoices and can reclaim input VAT on the goods or services they’ve bought from you, because HMRC say that you can’t reclaim VAT unless it’s shown on a proper VAT invoice.

Remember that VAT can be exceptionally confusing, so if you have any queries about VAT and how it affects your business in general, you should check with HMRC or speak to your accountant for more advice.

Emily Coltman FCA is Chief Accountant at FreeAgent, which provides the UK’s market-leading online accounting system for small businesses and freelancers.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

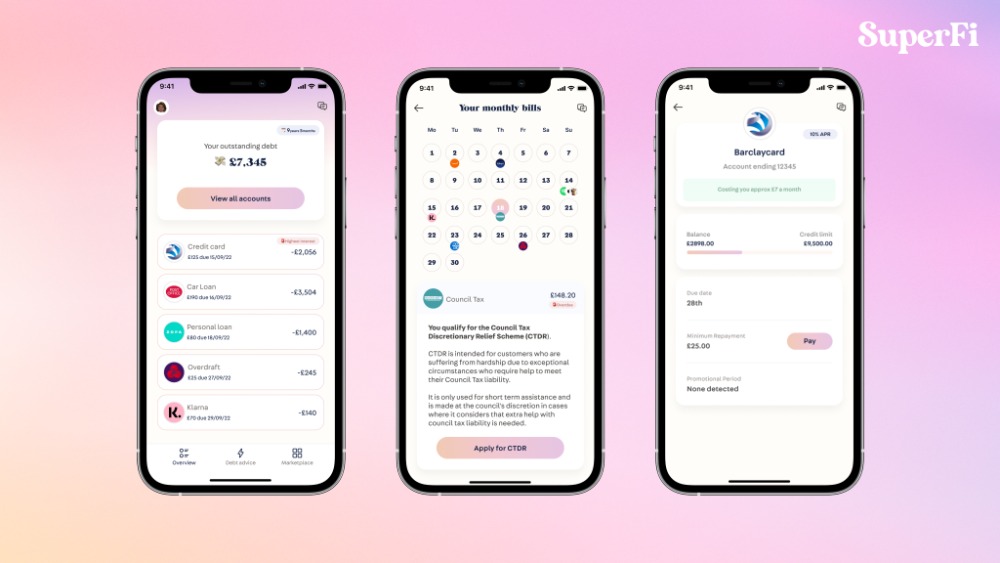

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

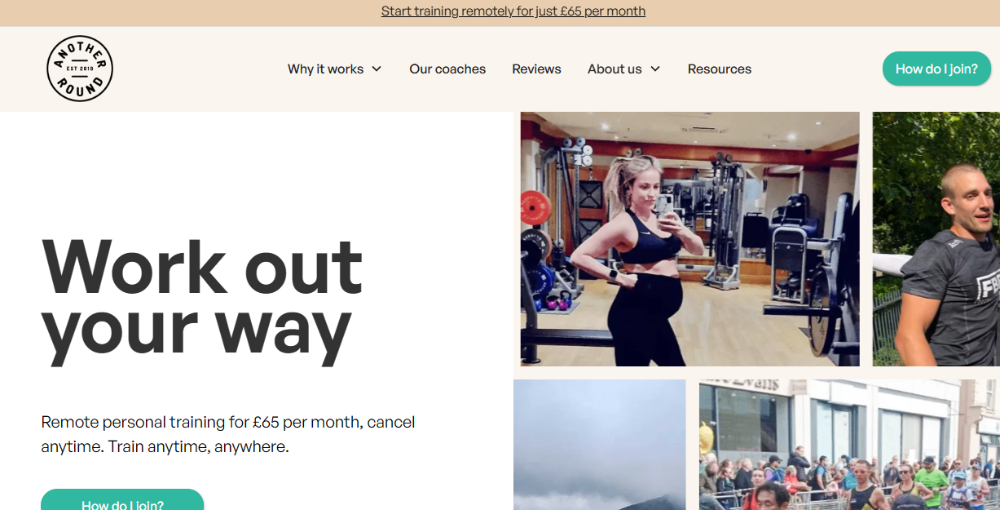

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

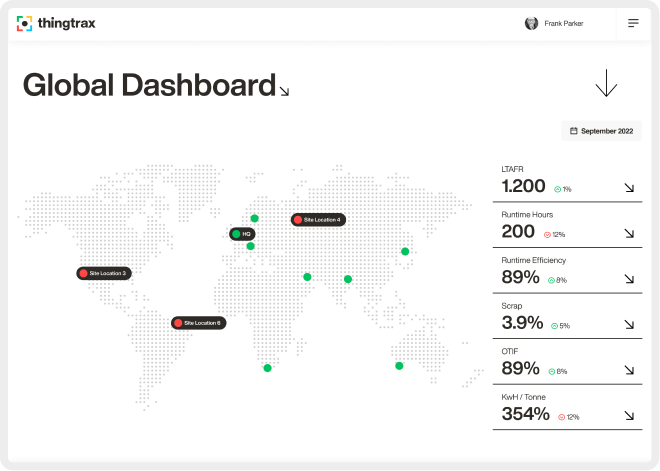

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 21st April 2014

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)