The legals to consider when using a room in your home as an office

by Startacus Admin

Thomas Taylor, Director of Net Lawman writes for Startacus on an assortment of legal issues that affect the UK small business and startup owner, whether it is starting that business or even growing or scaling it!

From the laws regarding disclosure of information about your business, what makes a legal agreement binding, through to the legal considerations on who makes the decisions in your company we are delighted to have Thomas on board writing such top-notch content on the site. This week the legal considerations when using a room in your house as an office get the rundown. Over to Thomas with all the info you will hopefully need...

“Many business success stories start with a couple of friends creating a product from a bedroom or garage that goes on to revolutionise a particular industry.

Using residential space in the early days has some great advantages: cash can be spent on product or service development instead of on a business premises’ lease, there is no wasted time spent commuting (especially if you are setting up at the same time as holding down another job), and the space is usually ready to use (subject to tidying a workspace).

However, it’s not just startups that are run from a home. Many people who offer consulting services also operate their business from their home. With few or maybe no other employees, and no visiting clients, there is no need for breakout areas, reception areas and other additional space that offices tend to provide.

If you do operate your business from home, you should be aware of the following:

Requirement to disclose your business address

By law, you must publish your business address in certain places. This was covered in full in the last article, but in summary, if you don’t want your home address to be made public, you should consider using a registered office address service.

Landlord and tenant law

Most assured shorthold tenancy agreements (the most common kind) explicitly forbid a tenant to run a business from the property.

The reason for doing so is that if a business is operated from the address, then the agreement cannot qualify as an assured shorthold tenancy under law.

This has several important implications because the rights and responsibilities of both the tenant and the landlord change or become void. One example relates to how notice to quit must be served.

The landlord particularly would be disadvantaged. He or she is unlikely to know whether a business is being operated from the address until problems occur – by which time it is often too late to solve them efficiently.

So if you rent a property, be aware that you shouldn’t run your business from it. That isn’t to say that you can’t work from home, but rather that the official business address must be elsewhere. Again, using a registered office address service could be an alternative.

Licences to use residential space as an office

Anyone who works at home can charge some of the cost of that space to the business, gaining tax relief from the additional expense. Effectively, you can reduce your rent by 20% on the portion paid by the business.

You can only charge a “fair amount” as a business expense, but often it can be worth doing so. There is no exact formula for calculating a fair amount, but it is generally accepted that it equates to the costs you incur in using the whole property multiplied by the proportion of space used for business multiplied by the proportion of time you work.

For example, you might take the rent or the mortgage interest you pay (but not repayments of capital), and add the cost of utilities, cleaning, council tax and insurance. This should be an annual figure. Then calculate the amount of floor space used for business purposes as a proportion of the total. This could be done on a floor area basis, or more simply, on a number of rooms basis. Also calculate the percentage of the year that you use the business space for.

Multiply all numbers together to work out an annual expense, and sense check it. As noted above, you can charge the business for electricity, gas, water etc as well.

You should document the agreement by you to the business in a written licence agreement (to use part of your home as an office) and, if your business is a company, approve the agreement in a board meeting documented by minutes.

If you own the property, you should make sure that you don’t licence the use of the rooms to the business entirely, otherwise, there may be capital gains issues when you come to sell it. Keep an element of personal use, even if this is just as a guest bedroom or a place to play your guitar.

About Thomas

Thomas Taylor is a director of Net Lawman, an alternative for small and growing businesses to using a solicitor to obtain legal documents. He is a qualified accountant (FCCA, FPA/FIPA).

If you like this post from Thomas, you might also like some of his other posts including:

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

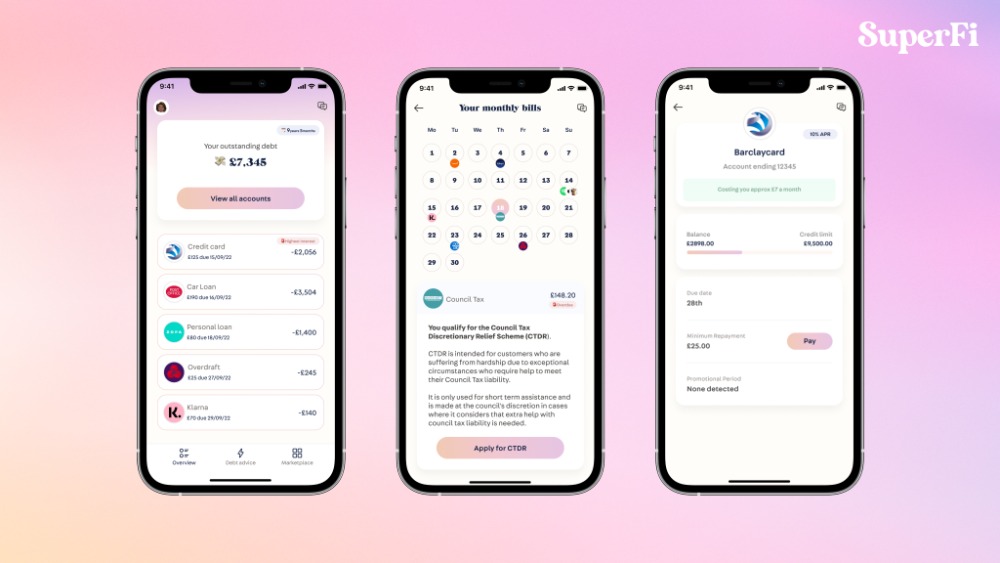

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

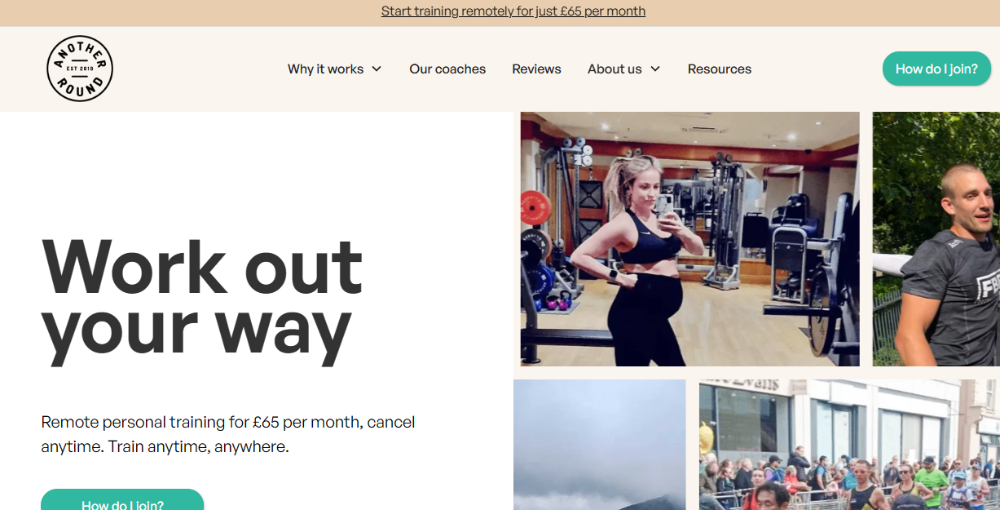

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

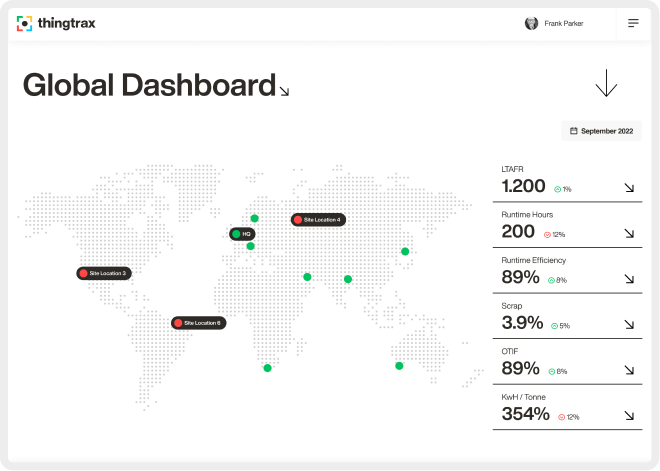

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 10th April 2016

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)