Get ready to raise for your startup in 2022

by Startacus Admin

Chantelle Arneaud from Envestors shares insights on how the startup/scaleup investment sector has fared over the last year and advice on raising money for your business in 2022.

As the pandemic continues entrepreneurs will be frustrated by the ongoing uncertainty. However, we know that despite everything your drive and ambition will help you though this next phase and you’ll be looking ahead to growth and the need to raise equity capital.

The competition for funds has been fierce so let’s look at the data for early-stage businesses from 2021 and offer some advice for entrepreneurs seeking to raise equity in year ahead.

All data is based on UK headquartered companies who raised equity capital from 01 January to 01 December in comparative years. Data comes from Beauhurst.

What do the stats tell us about the number of equity fundraises?

The number of equity fundraises in 2021 is slightly higher than in 2020 with a total of 5,315 versus, 5,278. Unsurprisingly this is still lower than 2019 and previous years. As the UK recovers from the economic (and emotional!) ups and downs the pandemic presented, we can expect to see the number of fundraises continuing to rise and get back to year-on- year growth.

Equity fundraises by year

Data from Beauhurst, includes equity fundraises in UK-based companies from 01 January 2021 to 01 Dec, 2021, 2020 and 2019.

Who’s getting the investment?

In reviewing the raises in 2021 we’ve focused in on earlier rounds to give a picture of what is happening in this part of the market. The number of rounds by broad business stage shows that seed stage companies accounted for nearly half of all the rounds in the year.

Excludes dead and exited businesses.

Often businesses do a number of smaller rounds, and it’s possible that the same business is being counted twice in any category. What do we see when we look at the data for the number of raises by round size?

This shows that 70%+ of all rounds were under a million and 40% were under £250k.

Does this mean you should raise £250k or less because there seems to be more activity there? Running multiple smaller rounds is worth considering, though strategy depends on which type of investor you’re targeting and is success is not guaranteed.

This data shows reported raises. No one reports unsuccessful raises, so while there have been 2,000+ successful rounds for £250k or less, it says nothing of those that failed to reach their minimum target. A conservative estimate is that half of businesses fail to reach their target.

Given what we know what should early-stage businesses do to prepare for a successful fundraise? Here are some tips:

-

You need more than a good idea

This isn’t unique to the current fundraising climate and is always important, yet many businesses fail to get this right. It is competitive out there. We receive hundreds of applications each month and see the same business ideas time and time again. A good idea alone is never enough. Make sure the problem you’re solving and how you’re solving it are clear. Use simple language. While you may be using some clever tech to solve a challenge, save the detail for later. Strip out the jargon, minimise the adjectives and write a description your mum can understand. If no one can understand what you do, no one will want to invest.

Differentiation is also key. What makes you so special? Everyone has a competitor- even if that is the option of doing nothing. So, outline how you are unique, how is that sustainable and be sure you’re taking an objective viewpoint. It’s easy to believe you are better than your competitors, but does anyone who doesn’t work for your business think that? If you don’t know, start asking your customers, prospects and partners.

Differentiation is also key. What makes you so special? Everyone has a competitor- even if that is the option of doing nothing. So, outline how you are unique, how is that sustainable and be sure you’re taking an objective viewpoint. It’s easy to believe you are better than your competitors, but does anyone who doesn’t work for your business think that? If you don’t know, start asking your customers, prospects and partners.

-

A strong team

Investors invest in people and in fact, many would take a good idea with a great team over a great idea with a good team. So, make sure you have a standout team. That includes sector experience, a balanced management team in terms of functional experience and any previous exits are a bonus.

If you are light in one area, it is a good idea to seek an advisor or non-executive director as that can give confidence to potential investors – as well as providing valuable advice and contacts.

-

Provide validation

Coming armed with proof that you have product-market fit and sustained growth goes a long way. If you have any big brands as customers or partners, you’ll want to highlight this as it provides further validation for your business. While this is important for all businesses, it is especially important for consumer brands and marketplaces. We see a lot of businesses in these categories and unless you have a growing customer base, your business is little more than an idea and therefore perceived as a big risk by investors.

-

Your deal and all the required documentation

Getting investment ready is a lot of work. It requires pulling together a host of documents from the subscription agreement to the cap table to the balance sheet.

We always recommend companies work with an advisor to create their deal as it helps ensure all information is available, professionally presented and credible. While there are many short-cuts, such as downloading templates from the internet, the risk of a poorly presented deal in such a competitive environment is just not worth taking.

-

The investors you will be targeting

The early-stage investment space is sprawling, disconnected and incredibly difficult to navigate. Be clear on what types of investor you want to target, be it angel investors, regional funds or VCs, and build a highly targeted list.

Avoid the temptation of going to LinkedIn and spamming anyone and everyone with the key word ‘investor’. Such an untargeted approach will not make you look professional and is unlikely to inspire confidence. If possible, work with a network like Envestors, which has deep knowledge of the players in the space as well as pre-existing relationships with investors. This will take away the guess work of trying to engage with potential investors on your own.

At present the early-stage investment space in 2022 is looking as though it will be similar to 2021. What does this mean for startup founders? With competition for funds continuing to be fierce, you’ll need to dedicate time and energy into preparing for the fundraise and remember to be patient. The process won’t be quick!

ABOUT THE AUTHOR

ABOUT THE AUTHOR

Chantelle Arneaud is from Envestors. Envestors’ digital investment platform brings together entrepreneurs and investors across geographies, communities and sectors – creating the single marketplace for early-stage investment in the UK. Envestors partners with accelerators, incubators and angel networks to provide a white-label platform empowering them to promote deals, engage investors and connect to other networks. Founded in 2004, Envestors has helped more than 200 high growth businesses raise more than £100m through its own private investment club. Envestors is authorised and regulated by the Financial Conduct Authority.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

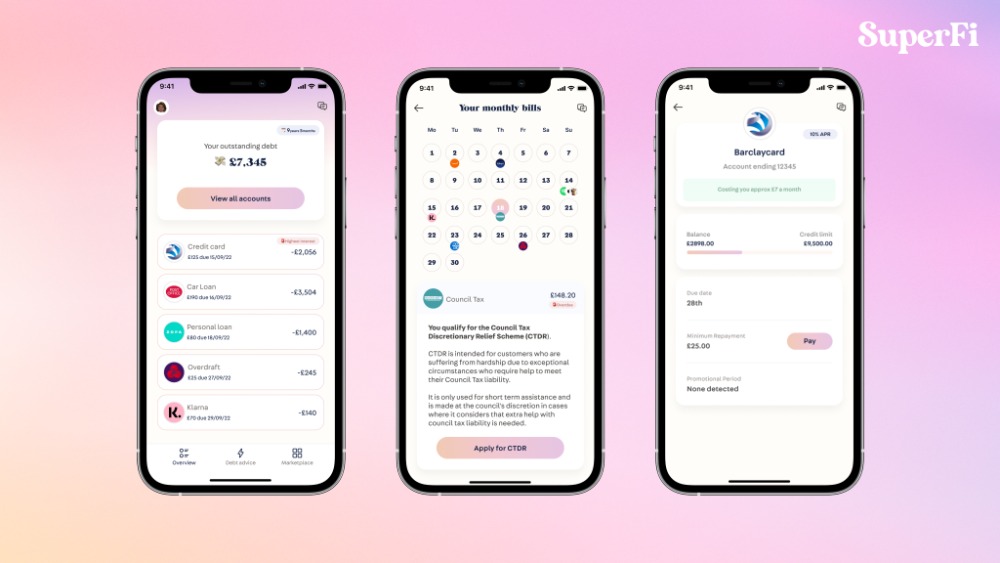

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

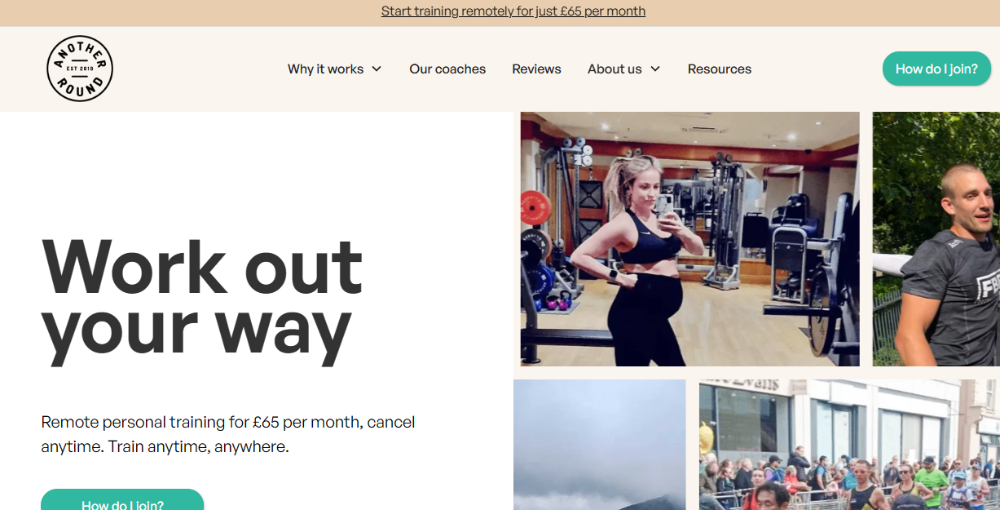

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

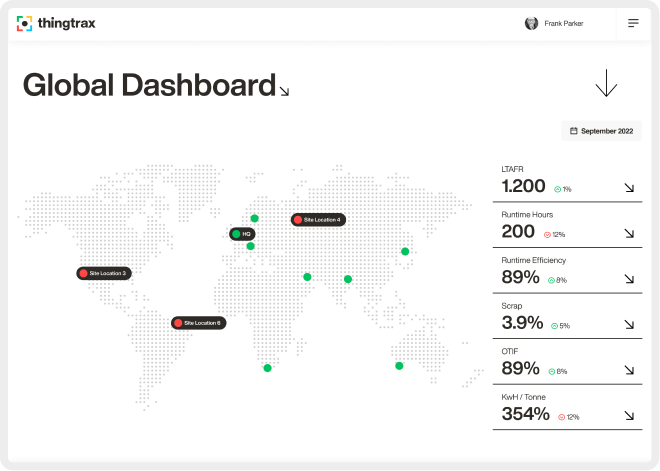

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 14th January 2022

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)