Get ready now for your first year of Self Assessment filing

by Startacus Admin

Did you become self-employed between 6th April 2012 and 5th April 2013? If you did, then this could be the first year you’ll have to file a self assessment tax return - and it must be with HMRC by 31st January 2014.

Emily Coltman FCA, Chief Accountant to FreeAgent - which provides an award-winning online accounting system for small businesses and freelancers - gives her top tips for how you can make self assessment as painless as possible.

for how you can make self assessment as painless as possible.

Are you registered with HMRC?

Firstly, you need to make sure that HMRC are expecting a tax return from you with self-employment pages.

Also, the deadline to file your tax return on paper has now passed, so you must file your tax return online now.

Make sure that you have registered your business with HMRC. Do this in good time, because HMRC have to send you an activation code by post.

What will your year end date be?

All businesses must prepare the accounts to a particular date every year. This is called your year end date.

The simplest year end date to have in the UK is one that matches the tax year, which runs to 5th April each year. By concession, HMRC treat accounts that end on 31st March, or any of the first five days in April, as matching the tax year.

You can choose whatever year end date you like, but a year end date that doesn’t match the tax year can result in you paying tax twice on the same profits in the early years of your business - though in later years it means you may pay tax later than otherwise.

Also, in your first year of business, you would have to report on your tax return your profit figure for when you started your business to 5th April 2013, even if 5th April 2013 was not your year end (unless your year end is 31st March or 1st-4th April, in which case you can use your year end).

For my own self I would stick to the tax year end - it’s much easier!

Don’t miss anything out when you draw up your accounts

You need to take into account all the transactions your business has had in the year. So if you started your business on 5th May 2012, and you choose a tax year end for your business, you need to include in your accounts all the transactions that happened between 5th May 2012 and 5th April 2013.

for your business, you need to include in your accounts all the transactions that happened between 5th May 2012 and 5th April 2013.

Don’t forget to include the following:

- Income that you had invoiced, or for which you’d done the work, before 5th April 2013, but which your customers did not pay you for until after that date.

- All your business costs, including those you paid for yourself rather than from the business’s bank account, and including any business costs that you incurred before the business started to trade, so long as you spent the money no more than 7 years before the start of your business and the cost could have been included if you had incurred it after the start of your business. So for example, you can include the cost of buying accounting software before you made your first sale, but not the cost of online gaming software (unless your business is in that industry).

- Any large pieces of equipment (capital assets) that you bought for your business. These don’t go in as day-to-day running costs but you may be able to claim capital allowances on them.

Don’t forget other sources of income

You may have income from other sources as well as your business, for example if you have a job as well as being self-employed, you rent out a property, or you earn interest on a bank account.

Collect the paperwork for this income, such as your forms P60 and P11D from your employer, or bank interest certificates.

Remember you need the paperwork that relates to the tax year 2012/13, the tax year which ended on 5th April 2013.

If you want an accountant - find one now

If you want an accountant to help you to prepare your tax return, now is the time to find one. However, be aware that some accountants may charge an extra premium to new clients who join them in the busy season

You can find friendly accountants here - and if you are at all worried about preparing your own tax return, do consult an accountant for help.

Emily Coltman FCA is Chief Accountant to FreeAgent, which provides an award-winning online accounting system designed to meet the needs of small businesses and freelancers. If you’re a sole trader, from January you will be able to “Fast File” your Self Assessment tax returns through FreeAgent instead of having to use HMRC Online. Try it for free at www.freeagent.com

If you are looking for more Finance related articles on Startacus - then click on this handy business finance link!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

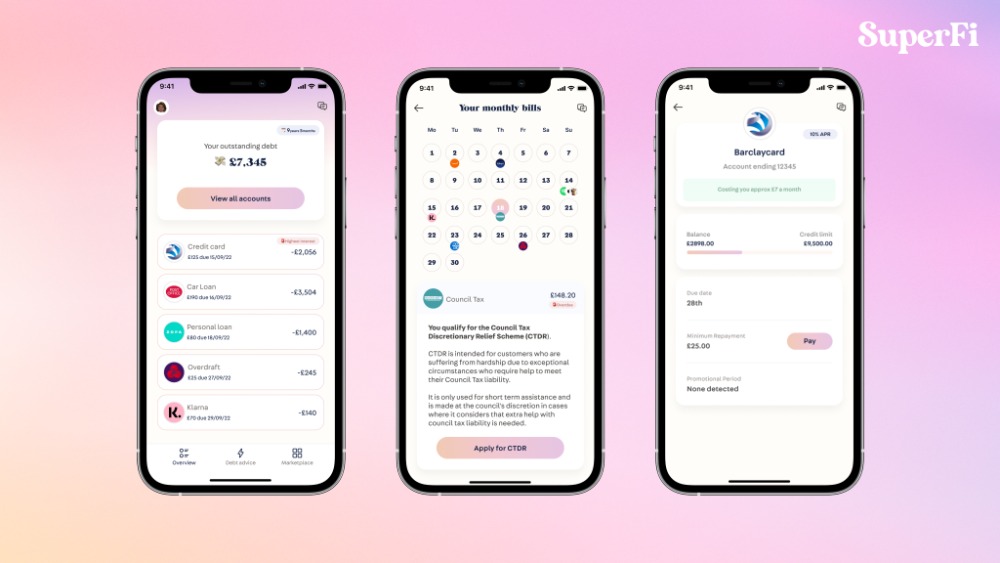

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

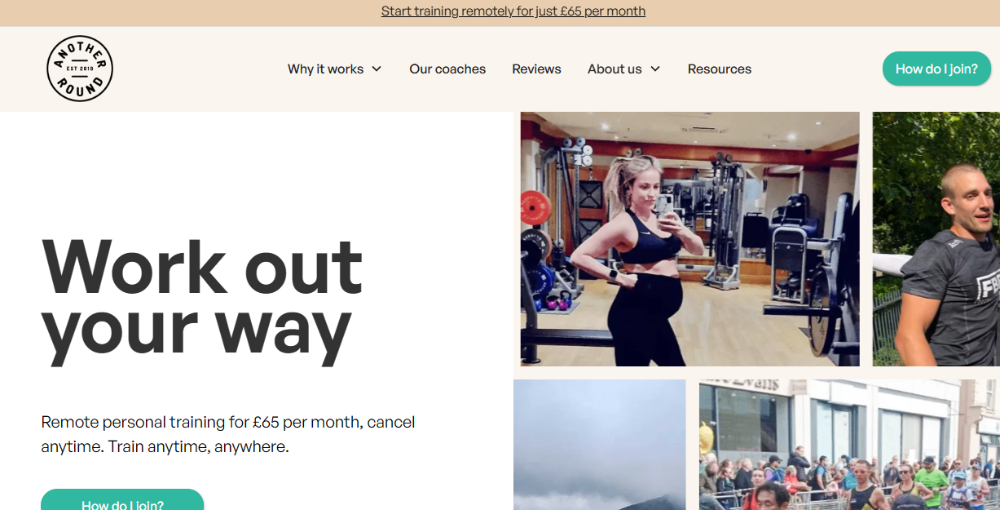

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

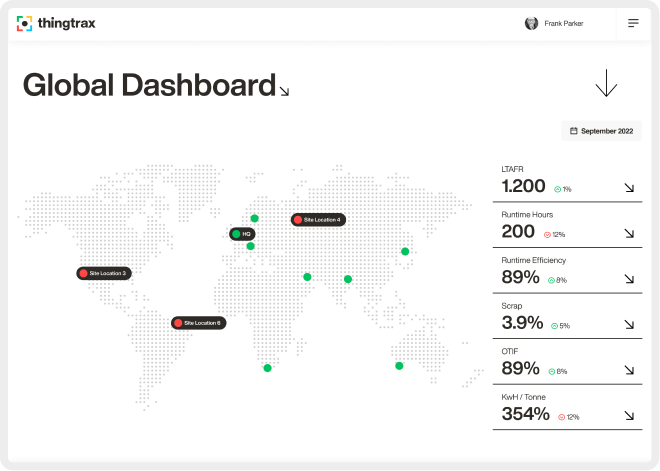

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 13th January 2014

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)