Four things you should know about the new Insurance Act

by Startacus Admin

Our friend Sophie Turton, digital and content marketing specialist at creative digital agency Bozboz shares 4 thoughts on the new insurance act, and what its likely impacts will be on businesses.

Our friend Sophie Turton, digital and content marketing specialist at creative digital agency Bozboz shares 4 thoughts on the new insurance act, and what its likely impacts will be on businesses.

Four things you should know about the new Insurance Act

The fate of businesses no longer lies in the hands of insurance companies. For the first time in over 100 years, you’ll be able to purchase business insurance, free from the draconian disclosure and warranty rules, which have given insurance companies considerable scope to avoid paying claims.

The Insurance Act 2015 will apply to all policies bought or renewed from 12 August 2016. Here’s how it relates to your small business:

The responsibility of disclosure will be shifted from the insured to insurer

The responsibility of disclosure will be shifted from the insured to insurer

Insured parties were previously required to disclose every circumstance that could influence an insurer when fixing a premium or underwriting a risk - this required business owners to predict, with very little guidance, what factors a hypothetical insurance company would be influenced by.

This has led to some sticky situations, where the policy has been breached and the insurer has avoided paying out entirely, leaving businesses without cover, which could result in a financial or material loss for the business owner.

The introduction of the new Act places the onus on the insurer, who must ensure they have all relevant information before entering into a contract. So long as you’ve provided your insurance company with “a fair presentation of the risk”, it is their responsibility to make further enquiries.

“The fate of a small business will no longer be at the whim of the arbitrary standard of a “prudent insurer” when a large claim is made,” Jerome O’Sullivan, Senior Dispute Resolution Solicitor at Healys International Law Firm, told us.

“However, there are still some grey areas. If in doubt as to what is required, you should always err on the side of caution and disclose everything relevant you know, and seek specialist advice”.

You must make sure you’re aware of the full picture

In addition to matters that you actually know, you should also reveal any issues that you ought to know - it’s your business and it is therefore expected that you would know of any damage or previous circumstances that could cause a risk further down the line.

For example, if you have suffered a minor theft or vandalism and didn’t feel it necessary to inform your insurance company, you could be in breach of your policy. You therefore need to ensure all information known to you and anyone related to your business is presented when you renew or buy your cover.

To ensure you’re on top of this, keep accurate records and put structures in place to encourage staff members to report any issues, even if they seem insubstantial.

Not as easy for insurers to avoid paying a claim

It’s now not as easy for insurers to turn down your claim entirely, even if they discover a material circumstance you previously hadn’t disclosed.

Under the Act, the insurer can only avoid the claim as a whole if they can prove that the non-disclosure was deliberate or reckless. If the non-disclosure was innocent, or merely negligent (you just didn’t think it was a big deal and forgot about it), this will result in proportionate consequences.

For example, if the insurer would have charged a greater premium had they known about a previous theft, then the claim would only be reduced by the same proportion. In the past, even if the material fact would not have changed the premium on your policy, the insurer could still refuse to pay the entire claim.

Immaterial breaches of warranty are no longer game changers

Insurance companies have also refused to pay out due to a breach of warranty that had nothing to do with the specific claim.

For example, there’s a warranty in your insurance that specifies that your burglar alarm needs to be inspected every six months and you accidentally miss an inspection. You have your burglar alarm serviced in month seven and in month eight you suffer a fire at your premises. Your insurance company could refuse to pay out - even though there is no connection between the burglar alarm (the breach) and the fire (loss claimed).

The new Act prevents insurance companies avoiding a claim due to unrelated issues.

Main takeaways

-

Ensure you disclose any information that could affect your claim, even if you don’t deem it substantial

-

Put processes in place to ensure your members of staff report any issue that could later affect your insurance policy

-

Seek increased input from insurers during the underwriting stage to make sure you’ve covered your back

- Seek legal guidance when purchasing your insurance to ensure you are completely covered – it is worth investing in this to protect your business further down the line.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

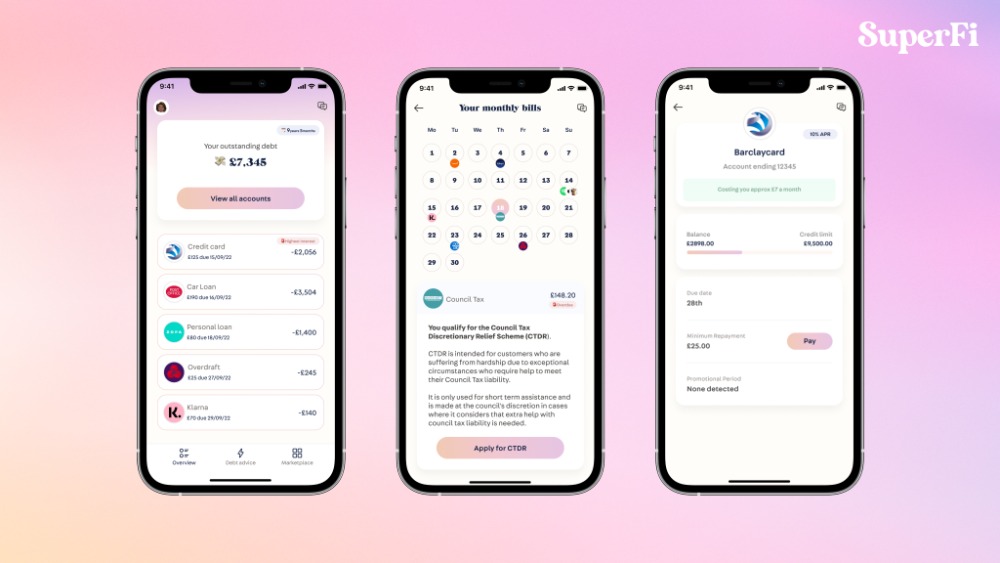

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

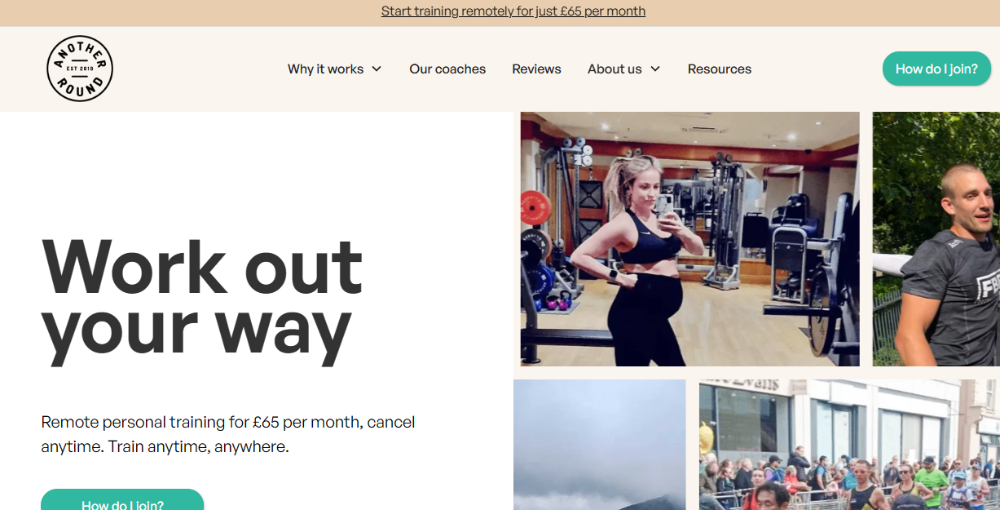

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

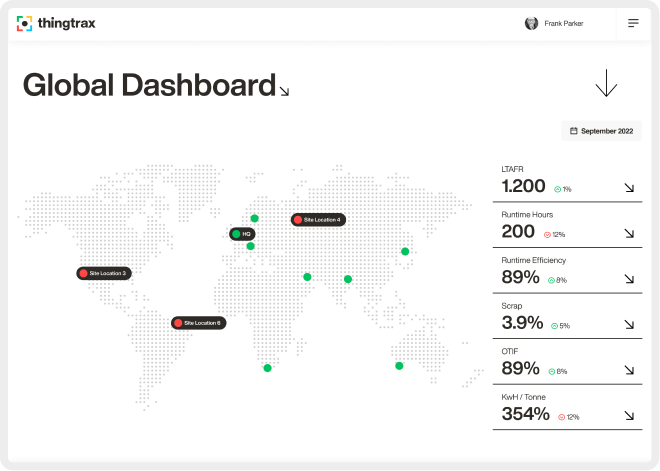

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 13th July 2015

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)