Advice For Small Business Owners: How to Avoid Closure

by Startacus Admin

It's a pretty challenging time to be a small business owner - these basic tips on what they can do to avoid closure whilst increasing profitability should help...

Unfortunately, there are a lot of small businesses out there which are currently struggling more than ever. It has been a busy year for business and now there are plenty of new companies cropping up each day. The competition is getting fiercer and is it becoming more difficult to stay afloat.

.jpeg) Most small businesses fail due to financial issues. Today, we will be discussing what small business owners can do to avoid closure whilst increasing that all-important profitability.

Most small businesses fail due to financial issues. Today, we will be discussing what small business owners can do to avoid closure whilst increasing that all-important profitability.

Assess Your Finances

To determine the success of your business and whether you can afford to keep operations running, it is important that you regularly assess your finances. Start by tracking how much money goes out of the business compared to what is going in. Ask yourself – is the cash flow steady enough? If it is not, then you will need to start looking into areas where you can cut costs. Investigate all areas of operations and you will be sure to find areas that can afford a cut back.

If you need to find ways to cut costs in your small business, then you can also turn to the internet for help. It is packed full of helpful blogs and articles which can steer you in the right direction.

Pay Off Your Debts

Any debt that your business owns will need to be paid. You can try ignoring them, but they won't go away, and they will only make your financial situation a lot worse. When it comes to paying off your debts you should prioritise them. Some will be more important to pay off than others. Taxes are one of the most critical debts for small businesses. It is important to remember, tax money belongs to the government and not your business. So, you should always place this as a number one priority.

Failure to pay off your debts could result in the closure of your business. Future Strategy know all too well about that as they have helped hundreds of small business owners in the closing down of their businesses over the years. It is a complex process and one you want to try and avoid.

Failure to pay off your debts could result in the closure of your business. Future Strategy know all too well about that as they have helped hundreds of small business owners in the closing down of their businesses over the years. It is a complex process and one you want to try and avoid.

Don’t Hesitate to Talk to Lenders

Clear lines of communication are crucial in business. If you are in times of financial hardship it can help to have a good relationship with your lenders at it can help to ease the situation of a late payment. For example, if you are unable to make scheduled payments on your business loans then speak to the lender at your nearest convenience. If you default a loan, it can have serious consequences. You may be subject to a late fee or lower your credit score. You may be able to avoid this if you can promptly explain your situation to your lender.

Being confident with communication doesn’t come naturally to all business owners. This is why it is advised that you look into ways that you can brush up on these skills. You can learn more about how to get confident with communication through various online resources.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

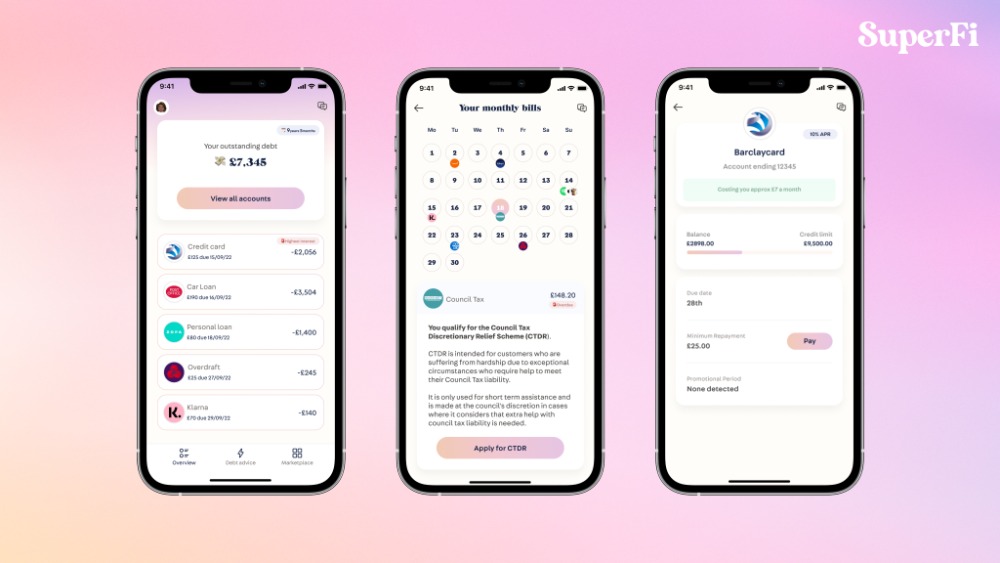

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

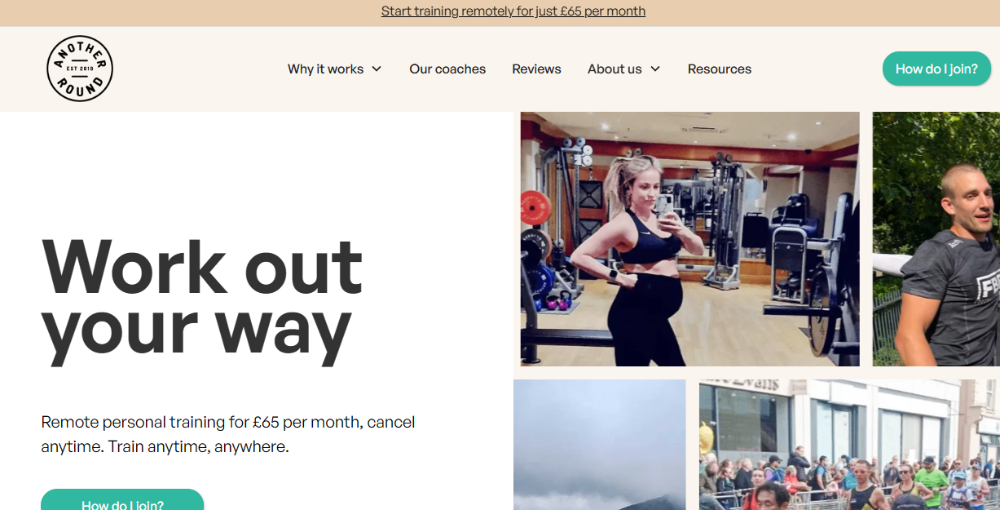

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

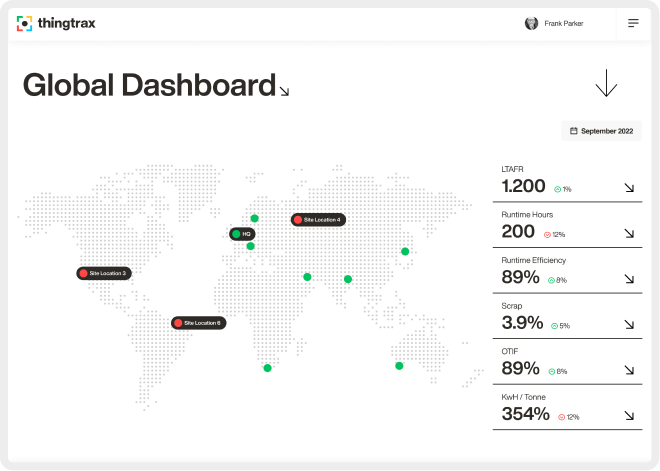

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 24th November 2021

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)