So you want to build a high growth web startup? (Part 3)

by Startacus Admin

In Part 1 of So you want to build a high growth web startup? Entrepreneurial Spark Start-Up Craig McDonald ,Co-Founder of StorkUp highlighted building an awesome deck, prototyping and grabbing yourself some beta users as three key pointers. In Part 2 of building a high growth web startup Craig’s post focused on getting a Technical Cofounder, learning to code and getting started with your Minimum Viable Product.

So over to Craig to start part 3, and it’s straight in at the deep end, with that often ignored subject - Money!

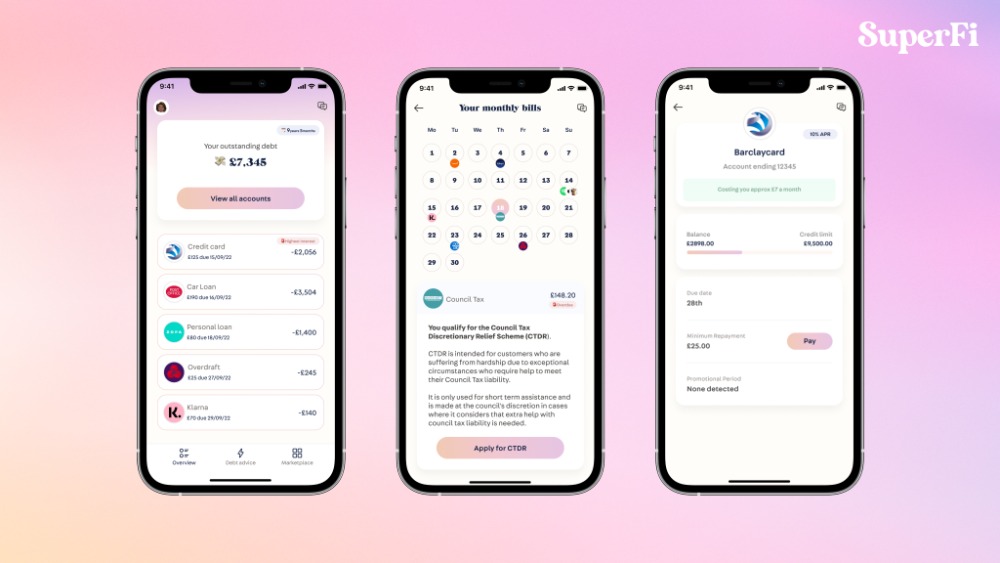

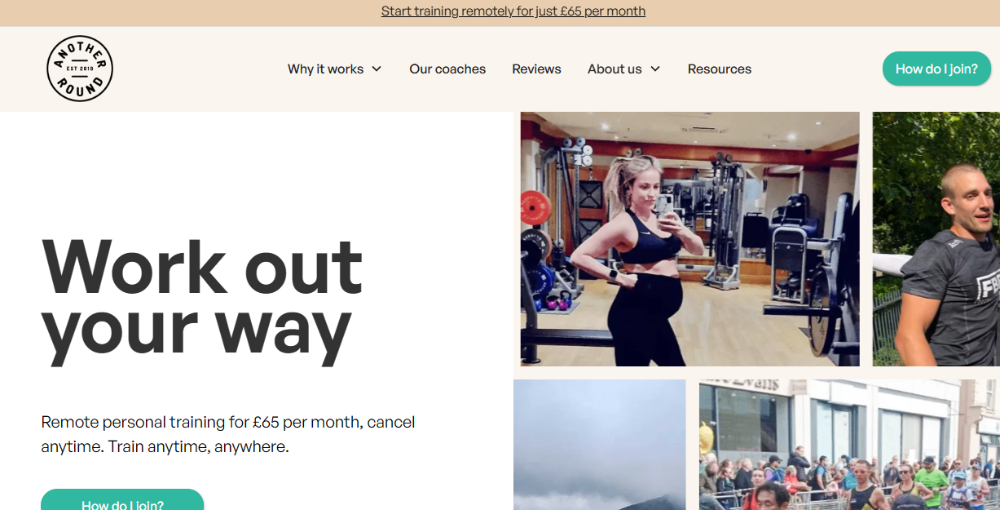

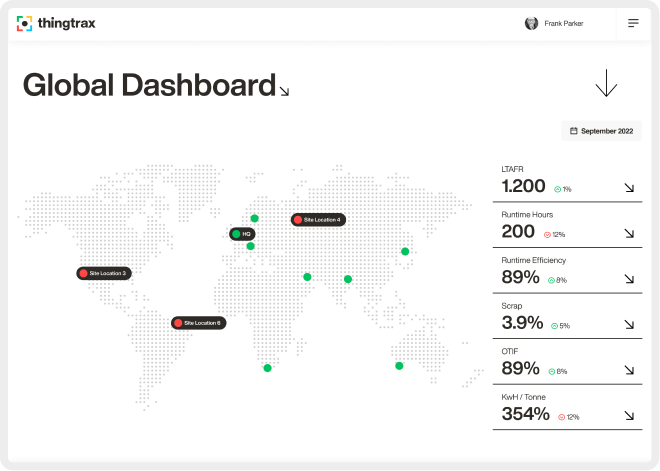

Got a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read... Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs. Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives. Roger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students. SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis. 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms. Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community. Thingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future A measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated Bedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Money, money, money…

Money, money, money…

Health Warning: None of the following should be read as being financial or legal advice. In fact, if you are a normal human being, some of what you are about to read will appear to be extremely irresponsible. Of course, you aren’t a normal human being, you are a high growth web startup founder…

Unless you are generating revenue from the start, you are going to need to raise some money to make your startup a reality. Your first round, in the absence of a stellar track record, is going to be a FFF Round which stands for “Friends, Family and Fools” – you personally fit in the last category .

If you cannot raise a five figure FFF Round, then perhaps doing a web startup is not the right thing for you at this stage – I am not saying this is an absolute rule, but if you can’t persuade your family to invest in you, then you are going to find it hard to persuade those that aren’t bound by unconditional love to do likewise.

Try to avoid giving up equity at this stage – put simply, you don’t want to have your granny as a shareholder when you come to raise further rounds from professional investors. Instead, get this money as an early-inheritance or as a very soft loan that you aren’t under any obligation to pay back for at least five years. If they do want to share in any upside, try to limit this to a handshake agreement to hand over a proportion of any wealth you later obtain from the business.

Your own contribution should ideally come from your savings if you have any or from less conventional sources if you don’t. Committed founders go to fairly extreme (and often very financially irresponsible lengths) to get funds for their startup’s FFF Round. Pawning your possessions, racking up credit card debit or taking out expensive unsecured loans is utterly stupid in most people’s eyes, but provided you have a way to repay this debt if things go wrong (i.e. getting a job for a while), then it can be a risk worth taking. Somewhere between £30k and £50k in total is ideal, although if you are able to code, then it can be as low as your personal burn rate x 6 – 12 months.

It might be tempting to fund your startup with consulting on the side rather than going down the FFF route. I’d personally strongly advise against this. For sure, it avoids you going cap in hand to your nearest and dearest (and keeps you out of debt), but it kills your focus and slows you down. You end up doing a crap job for your clients since you don’t really care about them, and unless you have no way of raising a FFF round it should be avoided.

As with any round, you need to clearly understand where this chunk of money is going to get you. At a minimum you should expect to build an MVP and have validated some of your biggest assumptions before the money runs out.

After your FFF round, the next money you’ll look to raise is your Seed Round. This is where you start to get yourself in front of professional investors for the first time.

Before you do, make sure you speak their language. This is one bit of advice I wish I had been given years ago – I still cringe at my amateurishness when I first started trying to raise money. Professional investors spend a huge amount of their time vetting potential investments and as such they see dozens, if not hundreds, of smart, interesting teams every single year. If you can speak their language, it can help to demonstrate that you are worthy of their time (and hopefully their money).

Brad Feld, one of the founders of Techstars, has very kindly written a fantastic book that will help you master the language of smart money investors. So before you meet your first potential investor, read Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist and fill in the rest of the gaps in your knowledge using Quora.

Continued on page 2!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here.

How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy Costs SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance Gap How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives  How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AI SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding round Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal training Thingtrax Secures £4.3M

Thingtrax Secures £4.3M A measure of inflation relief for small firms

A measure of inflation relief for small firms A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHub

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)