Real Time Information - An update

by Startacus Admin

Joshua Boyd from online accountants Crunch, guest writes for Startacus on the impact (so far!) of Real Time Information...

Every so often a big change will come to tax law that involves a massive overhaul of the system for whatever reason. The most recent such change was Real Time Information, or RTI. It was brought in with the new tax year back in April. The change affected any business who operated a PAYE system meaning it a massive chunk of British companies had to make use of this new system.

new tax year back in April. The change affected any business who operated a PAYE system meaning it a massive chunk of British companies had to make use of this new system.

Before RTI a company would give HMRC all the PAYE details of their employees, such as pay, National Insurance etc., at the end of the year in one go. While meaning it only had to be dealt with once every 12 months, it did mean the chances of losing information increasing and it generally creating a bit of a mammoth task. HMRC decided this wasn’t the way to go and so brought in RTI.

What that means is that now companies have to produce a report each and every month so that HMRC can be kept up to date. The reason for this was to improve efficiency and to also decrease the amount of under of overpaid tax as mistakes can be rectified on a month-by-month basis. While sounding like it might cause more hassle, HMRC’s method for the collected the data should have meant that it would take far less effort.

All the information is collected electronically by connected a company’s payroll system to the Government Gateway. Once everything is setup the information is sent automatically and the business owner just has to keep their records up to date and that’s that. No more big report at the end of the year.

All the information is collected electronically by connected a company’s payroll system to the Government Gateway. Once everything is setup the information is sent automatically and the business owner just has to keep their records up to date and that’s that. No more big report at the end of the year.

Failure to do so would of course lead to fines, but HMRC showed some leniency by saying that no one would be fined until after the new tax year. This means that you could fail to do anything, but if it was all sorted by April 2014 the taxman would give you a pass. Smaller businesses (50 and lower) were also given some time to be exempt as it was said they would be disproportionately negatively affected. This has now been extended until April 2014.

The system has struggled with glitches since its inception. As recently as the 4 June, users were reporting lost or omitted data that meant the wrong tax was paid. This is of course causing what RTI was meant to eradicate, wasted time. This hasn’t been across the board though and hopefully HMRC will learn from these issues and ensure they don’t continue.

RTI is a good idea in theory, but, with pretty much every initiative brought in by HMRC, it has had its teething problems. Luckily they had the foresight to over exemptions and some leeway with fines, so by the time that’s over hopefully the glitches will be too.

Joshua Danton Boyd is a copywriter for the online accountants Crunch.

Still confused about Real Time Information you might want to read our previous post on just that - Real Time Information - what is it?

Join Startacus - the Self Start Society!

If you like what you see here on Startacus, why not become a member of our growing community? It's free! And you'll get all this - exclusive access to our Business Toolkit, discounts and offers galore for your business via our member only business deals, the chance to network and connect with loads of fellow self-starters, and maybe even become our celebrated 'Self-Starter of the Week' and tell the world your startup tale! Join right here for free...

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

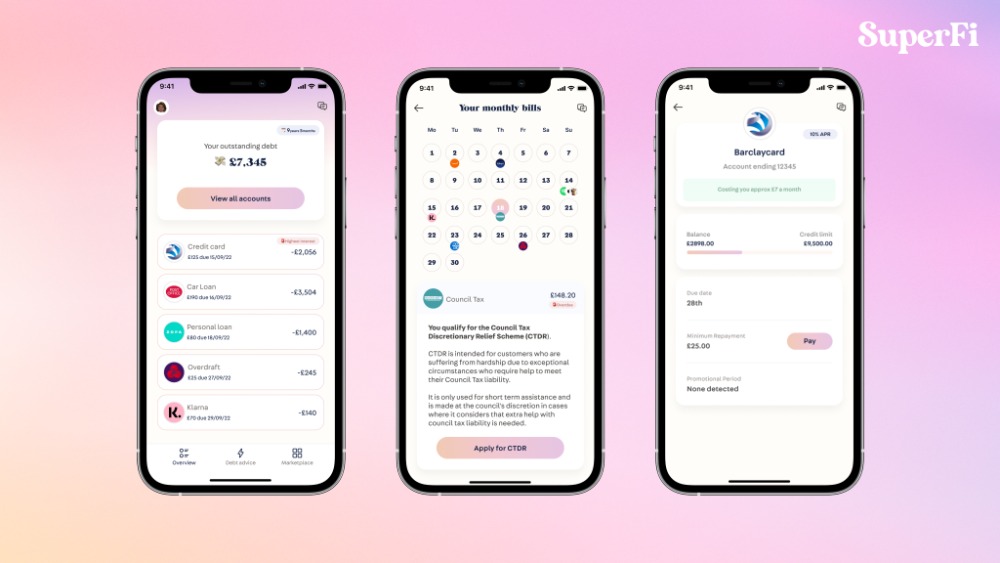

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

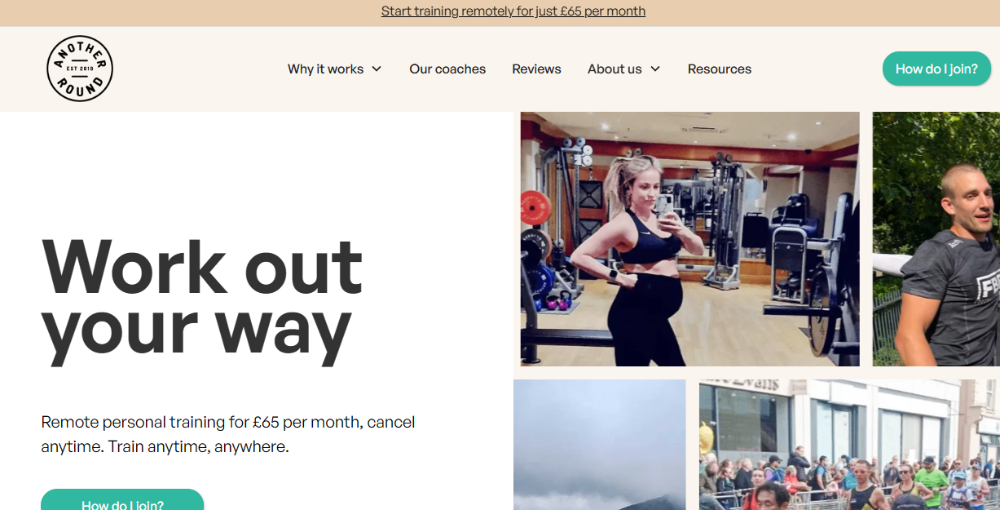

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

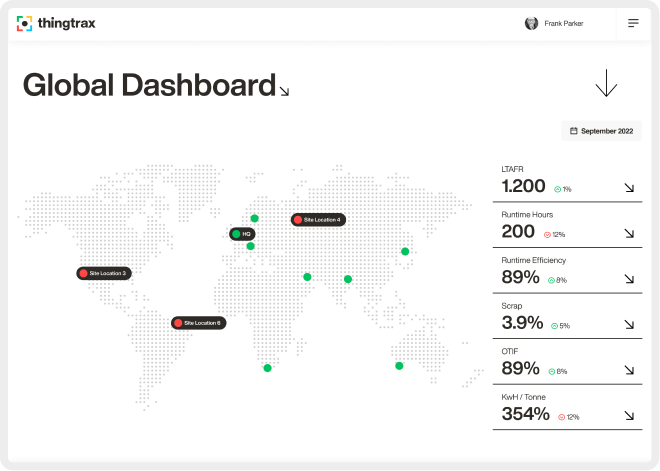

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 28th June 2013

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)