Information on the Legal Issues of Setting up a Popup Shop

by Startacus Admin

The Legal issues of seting up a popup shop

Over the past few weeks we have been undertaking the enormous task of compiling as much specific and detailed information about the process of setting up a popup shop as possible.

Yesterday we talked about how to select and secure your pop up location and the many things that you need to consider. Today we will be doing valiant battle with the big boys - the legal issues...

battle with the big boys - the legal issues...

You guys have been in contact in your droves about this - telling us how hard it is to find out the specific info that you need to make sure you are staying on the right side of the law. Luckily we have done most of the leg work for you, here is what we found…

-

Licensing - If you plan to offer any form of regulated entertainment within your popup location you will need to apply for special privilege to do this from the licensing authority of your local council (assuming that your popup will last for more than 168 hours, if not you will only need a license to sell alcohol). Regulated entertainments include hot food, alcohol, performance of a play, film exhibition, indoor sporting event and the playing of live/recorded music. For the temporary provision of alcohol you need to apply for a Standard Temporary Event Notice (TEN) which needs to be granted 10 days before the beginning of the event, OR a Late Temporary Event Notice which must be given no less than 5 days from the beginning of which must last no more than a 168 hours and be be in a venue which host 12 or less similar temporary events per year. If you wish to provide regulated entertainments for a longer period of time i.e. in excess of 168 hours you will need to be granted a premises licence which can also be granted by the licensing authority at your local council.

-

Health and Safety - These do not differ from the standard rules and regulations you would expect in any commercial environment. You should also undertake the following to ensure you are not in breach of the law; carry-out a health and safety risk assessment, write a health and safety policy, provide training to your staff, provide the appropriate welfare facilities for your staff and have appropriate first aid provisions. The UK government has some great information on the specifics of these tasks which can be found here (www.hse.gov.uk). Alternatively you may wish to enlist the assistance of an external health and safety auditor such as the charity British Safety Council which will help you to confirm that your health and safety arrangements meet the required standard.

-

Insurance - If you plan to employ staff you will need to get yourself employers’ liability insurance to help cover the costs if an employee is

injured at work or gets ill as a result of the work that they are doing for you. There are some exceptions to this rule - such as in the case of a family business where all employees are closely related to you however normally you will need insurance from an insurer who has been authorised by the Financial Conduct Authority (FCA) visitwww.fca.org.uk for a list of approved insurers.

injured at work or gets ill as a result of the work that they are doing for you. There are some exceptions to this rule - such as in the case of a family business where all employees are closely related to you however normally you will need insurance from an insurer who has been authorised by the Financial Conduct Authority (FCA) visitwww.fca.org.uk for a list of approved insurers. -

Registering as an employer - If you will be employing anyone (even yourself) you will usually need to register as an employer with HM Revenue and Customs well in advance of your employee’s first payday. In many cases this can be completed via email or over the phone. You can find all the specifics via the HMRC ‘How to register as an employer’ page (www.hmrc.gov.uk/payerti/getting-started/register.htm).

-

Registering your business and Taxation - The easiest way of ensuring that your popup shop is fully compliant with government’s expectations is to register as a sole trader with HM Revenue and Customs. A sole trader is a person who runs their own business (is self employed) and keeps all the profits of their venture after the necessary tax has been paid. Once you have opened your business you will need to register for tax self assessment as soon as possible. Your tax return can be completed either in paper form or online (once you have set up an account). For more information on the ins-and-outs of self assesment as a sole trader check out the government guidelines (https://www.gov.uk/selfassessment-tax-returns/who-must-send-a-tax-return).

"Phew! What a lot of info, but it’s really not as complicated as it looks…if in doubt about legal or tax issues* though, your first port of call should always be www.gov.uk and if you cant find what you need, give them a call. And for our American neighbors, a variety of online tools can be found here. In the US there are also government organisations such as the SBA (small business association) that can provide the information you may need."

*Of course, we are also not legal eagles, so do also make sure that you contact your local council, chamber of commerce or enterprise body (and so on) to see if they have any legal information that you should adhere to or someone that you can be referred to.

If you’re interested in the popup phenomenon why not check out some of our other features on the subject.

Mr Quiffy - The popup ice cream van fashion store

Number 26 - The popup shop turned stopup shop

Sherston - The Popup Village

Join the Self Start society! If you like what you see here on Startacus and want to get involved yourself, why not become a member of our growing community by joining for free here!

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

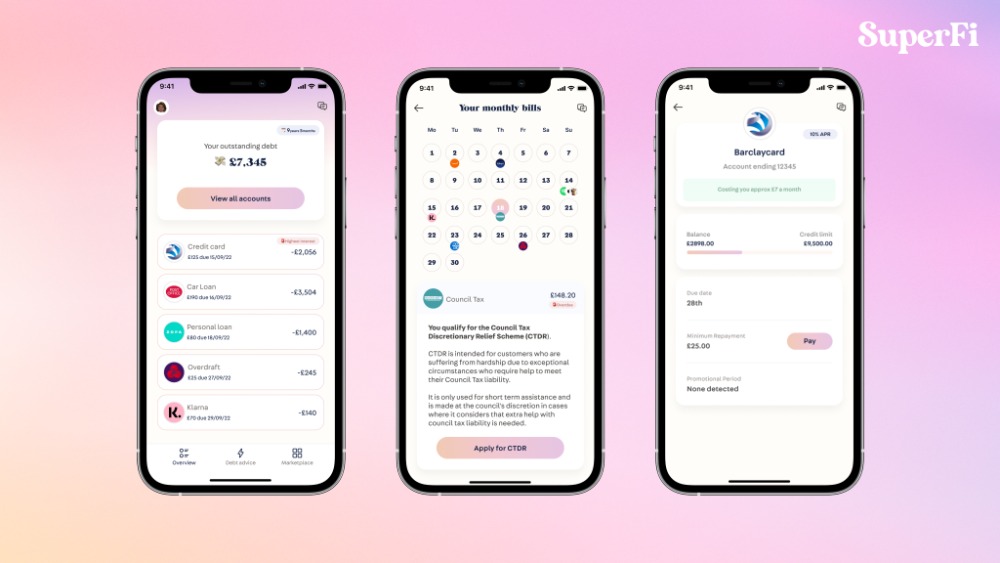

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

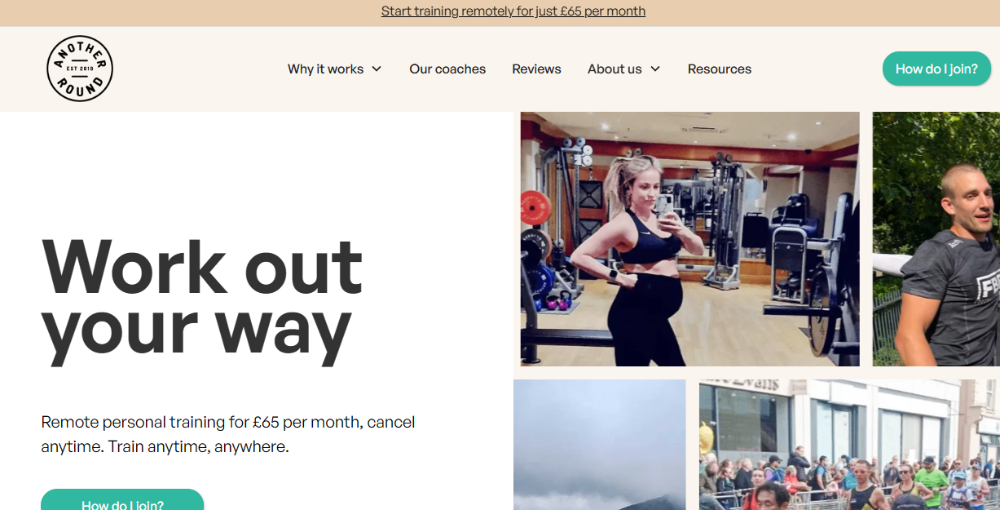

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

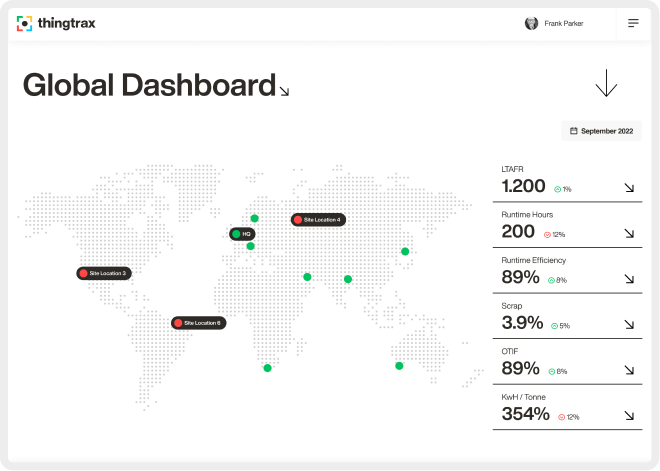

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 23rd October 2013

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)