How and When to register for VAT

by Startacus Admin

Are you starting a business? We supply the lowdown on VAT in the UK and Ireland - how and when to register and who has to do it!

Are you starting a business? We supply the lowdown on VAT in the UK and Ireland - how and when to register and who has to do it!

VAT? *yawn*... Many of us, particularly the more creative amongst us, probably feel the same when the whole matter of VAT rears its’ head. However whilst it may be deemed the “boring stuff”, if you are serious about business, it’s one of those things that has to be dealt with, like it or not. To help you out just a little bit, here are some of the basic things you need to know about VAT.

In the UK?

Who has to register?

If you have a business and the turnover is more than the VAT threshold, you have to register. Since April 2014 that threshold has been £81,000 and this is likely to rise again at the beginning of the next tax year. Therefore if the value of what your business has sold over 12 months is greater than this, you have to register.

If however your sales are below the threshold, you can still do a “Voluntary Registration”. Why? Well, if the majority of your sales are to VAT registered businesses, you may yourself be able to reclaim VAT on any business expenses you incur

When to register?

Every month, you ought to be recording what your sales and potential taxable turnover is and obviously adding it up. As soon as your sales reach the threshold limit, you must apply for VAT registration within 30 days of the end of the month when this happened. If you reach the threshold before 12 months is up, don’t make the mistake of holding off - you could incur a penalty. Of course, as mentioned above, Voluntary Registration can be done before the threshold is reached.

How to register?

There are several forms available on the HMRC site and depending on your business, one or more have to be completed and submitted for approval. VAT registration forms can be printed to complete manually or in many cases can be done online. When you do this, you’ll then be given a VAT registration number and a certificate. You can also use online accountancy services who can do it all for you.

Subscribe to our newsletter

If you would like to receive our startup themed newsletter, full of the latest startup opportunities, events, news, stories, tips and advice, then sign up here. How Manufacturing Businesses Can Reduce Energy Costs

How Manufacturing Businesses Can Reduce Energy CostsGot a business in the manufacturing sector? These tips on how you can reduce energy costs while being more sustainable are well worth a read...

SureIn Secures €4M to Close the SMB Insurance Gap

SureIn Secures €4M to Close the SMB Insurance GapInnovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

How IoT Is Revolutionising Consumers' Daily Lives

How IoT Is Revolutionising Consumers' Daily Lives Nassia Skoulikariti, Director of IoT Programmes, Mobile Ecosystem Forum shares some insights on how IoT is having a significant impact on all our lives.

How to invest in tech companies with the help of AI

How to invest in tech companies with the help of AIRoger James Hamilton, Founder and CEO of Genius Group, a world-leading entrepreneur Edtech and education group, discusses how introducing a globalized curriculum will help better prepare students.

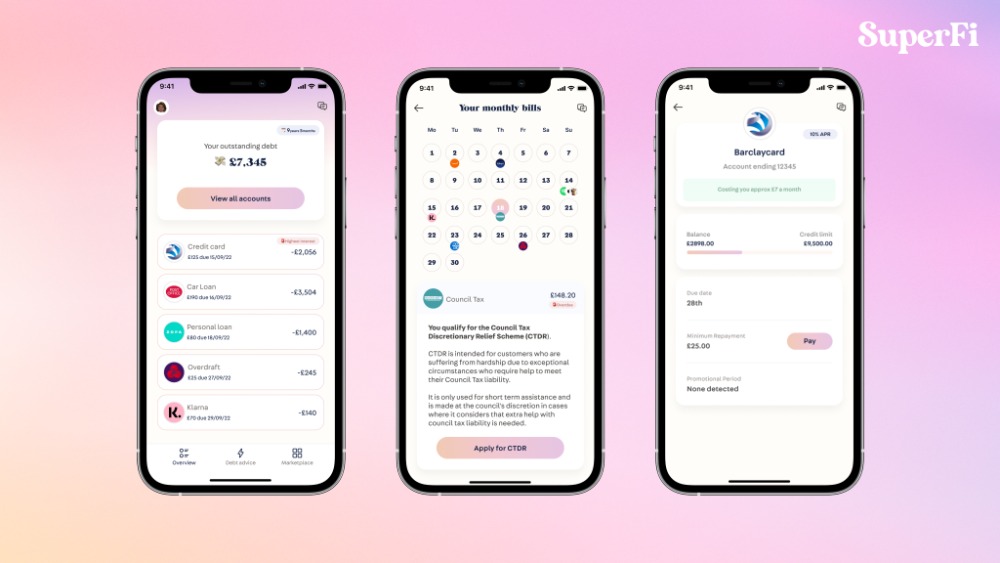

SuperFi raises $1M pre-seed funding round

SuperFi raises $1M pre-seed funding roundSuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

Startups rely on AI & sustainability for new partnerships

Startups rely on AI & sustainability for new partnerships41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

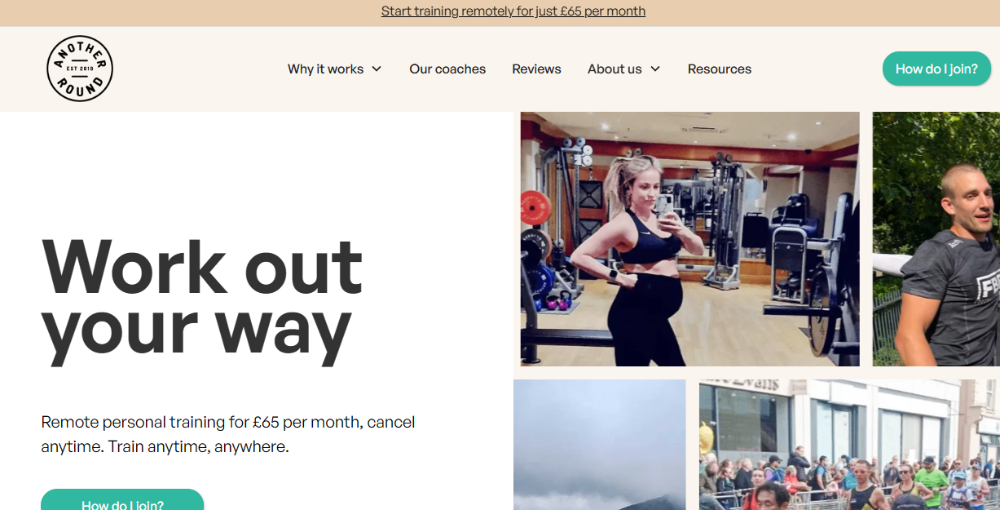

Another Round closes £300k Seed round to revolutionise personal training

Another Round closes £300k Seed round to revolutionise personal trainingPersonal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

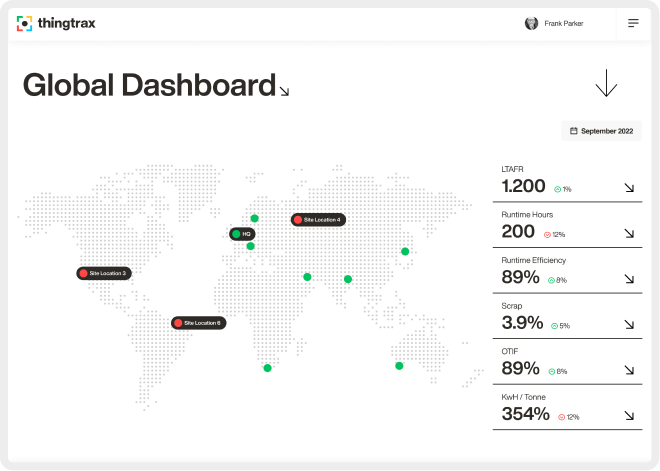

Thingtrax Secures £4.3M

Thingtrax Secures £4.3MThingtrax Secures £4.3M to Empower Manufacturers to Build the Factories of the Future

A measure of inflation relief for small firms

A measure of inflation relief for small firmsA measure of inflation relief for small firms sees transport costs fall but service price increases remain elevated

A look at HR tech startup HR DataHub

A look at HR tech startup HR DataHubBedfordshire-based HR tech startup HR DataHub has built a range of tools for HR departments

Published on: 18th September 2012

If you would like to enable commenting via your Startacus account, please enable Disqus functionality in your Account Settings.

- SureIn Secures €4M to Close the SMB Insurance Gap 15th Aug 2023 Innovative InsurTech startup SureIn announces a €4M Seed round to further its mission of making insurance easy, transparent and hassle-free for SMBs.

- SuperFi raises $1M pre-seed funding round 28th Jul 2023 SuperFi, the debt prevention platform, has announced a $1m pre-seed funding round to support people during the cost of living crisis.

- Startups rely on AI & sustainability for new partnerships 27th Jul 2023 41 startups from 13 countries, including the UK, have been selected for the 8th Kickstart Innovation program, one of Europe’s leading innovation platforms.

- Another Round closes £300k Seed round to revolutionise personal training 21st Jul 2023 Personal training platform Another Round has secured £300k in its latest fundraise, including investment from angels and its community.

Daniel Dierkes, David Schara, and Maximilian Geißinger 2.jpeg)

.jpg)